Adani Group stocks experienced a significant uptick on Friday, with gains ranging from 0.2% to 8.4%, following the Indian markets regulator’s dismissal of certain allegations made by short-seller Hindenburg Research. The Securities and Exchange Board of India (SEBI) cleared two charges against the conglomerate, signaling a potential end to its regulatory challenges. Adani Total Gas led the surge with an 8.4% rise, marking its best performance in over four months, while Adani Enterprises saw a 4.2% increase. Adani Power climbed 7.4%, bolstered by Morgan Stanley’s ‘overweight’ rating. The SEBI’s investigation, initiated in 2023, scrutinized claims of tax haven usage and undisclosed related-party transactions. However, the regulator concluded that these transactions did not violate disclosure norms or constitute market manipulation. Deven Choksey of DRChoksey FinServ noted that the SEBI order could restore investor confidence, which had been shaken by the Hindenburg report. Despite the initial $150 billion market value loss, some Adani stocks have rebounded, with Adani Power, Adani Ports, and Ambuja Cement recovering significantly. However, other group stocks remain 20% to 80% below pre-Hindenburg levels. ICICI Securities highlighted that the regulator’s decision removes a major overhang, potentially boosting institutional investor confidence in Adani Ports.

博客

-

Italian deputy PM talks up autos ties with China amid EU trade tensions

Italy’s Deputy Prime Minister Matteo Salvini emphasized the potential for enhanced collaboration between Italy and China in the automotive and transportation sectors during an interview with China’s state news agency Xinhua. The remarks were made amidst ongoing trade tensions between Beijing and the European Union (EU), particularly over allegations of unfair subsidies to Chinese carmakers. Salvini, who also serves as Italy’s transport minister, highlighted the ‘broad prospects for cooperation’ in areas such as smart roads, high-speed rail, and autonomous driving technologies. He praised China’s advancements in high-speed rail, noting that while Italy aims to achieve speeds of 300 km per hour, China is already exploring speeds of up to 500 km per hour. Additionally, he lauded China’s progress in artificial intelligence and innovation. Despite Italy’s support for the European Commission’s 2024 decision to impose tariffs on Chinese electric vehicles, the country has sought to maintain positive relations with Beijing. Prime Minister Giorgia Meloni’s government has continued to welcome Chinese investment, even after Italy’s withdrawal from China’s Belt and Road Initiative. Salvini expressed optimism about the potential for infrastructure development between the two nations. However, the broader EU-China relationship remains strained, with the EU imposing tariffs on Chinese electric vehicles and China retaliating with anti-dumping duties on European pork and brandy, as well as investigations into the dairy sector.

-

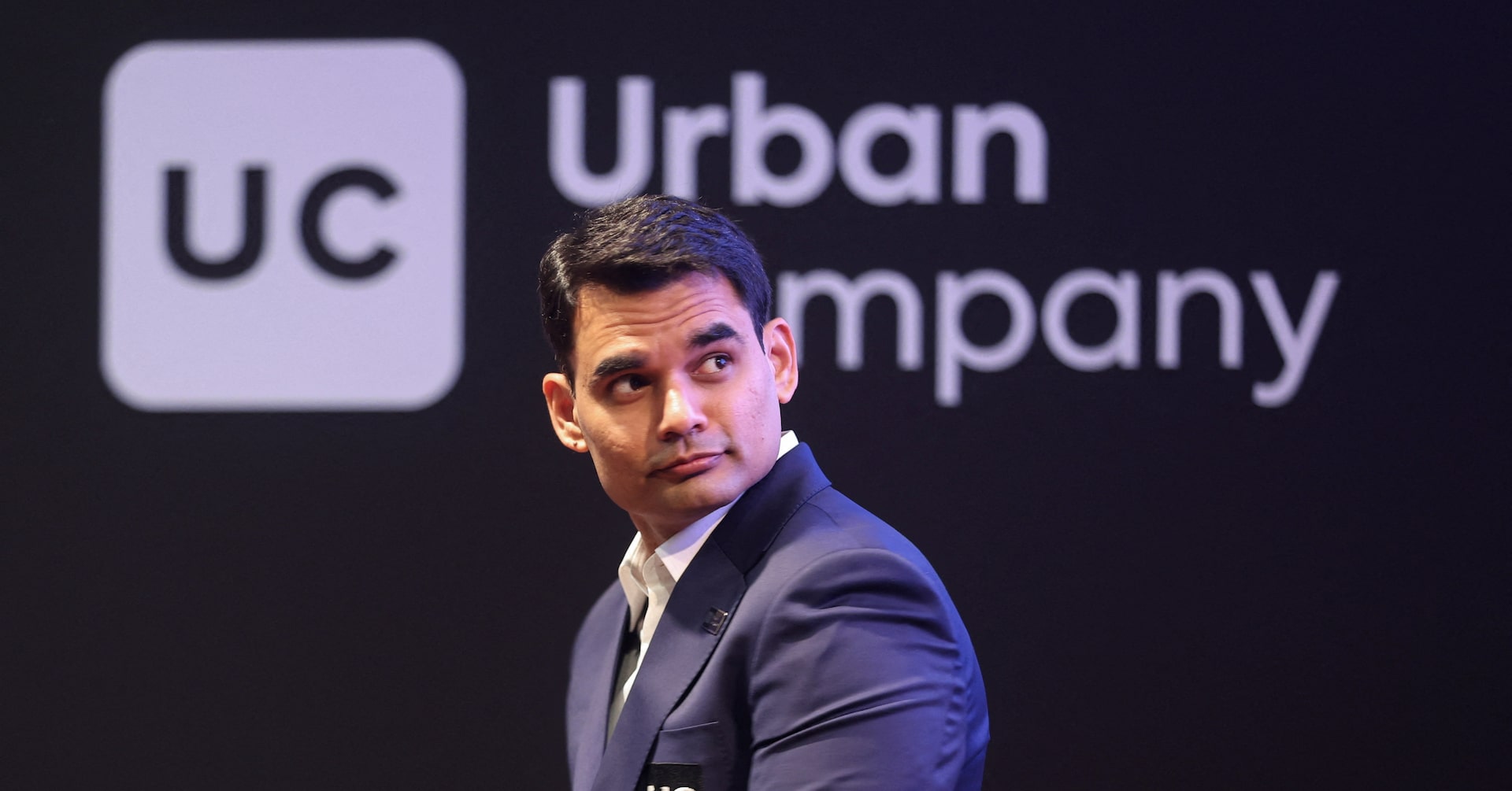

India’s Urban Company plans big bet on instant home services, CEO says

Urban Company, India’s leading home-services provider, is intensifying its focus on delivering services within an hour, aiming to cater to the growing demand for instant solutions in a market accustomed to rapid deliveries of groceries and gadgets. This strategic shift comes on the heels of the company’s successful IPO, which marked one of the most anticipated stock market debuts of the year. Traditionally known for allowing customers to schedule services like facials and faucet repairs, Urban Company is now emphasizing speed with its new ‘Insta Help’ service, enabling users to book domestic workers in just 15 minutes. CEO Abhiraj Singh Bhal highlighted the significance of instant services, stating that they could create a sustainable competitive advantage and drive customer engagement. As of June 30, the company boasted 7.02 million annual transacting customers. Urban Company plans to invest heavily over the next two to three years to build a dense network of service professionals in its core markets, though this may pressure profit margins. The company faces competition from startups like Pronto and Snabbit, which promise services in as little as 10 minutes. Analysts note that while the market potential for instant services is significant, logistical challenges and operational complexities could hinder growth. Despite these hurdles, Urban Company’s online on-demand services market is projected to grow at a compound annual growth rate of 22.4% from 2023 to 2030.

-

Apple’s iPhone 17 launch draws hundreds in long queue at its Beijing store

On September 19, 2025, Apple’s latest iPhone 17 series made its debut in Beijing, drawing hundreds of eager customers to the flagship store in the bustling Sanlitun district. The launch marked a significant moment for Apple in China, the world’s second-largest economy, as analysts predict the new models could revitalize the company’s market share amid fierce competition from local brands like Xiaomi and Huawei. Shuke Wang, a 35-year-old customer, was among the early adopters, opting for the Pro Max model priced at 9,999 yuan ($1,406). He praised the series’ redesign, particularly the orange variant, though he found it slightly flashy. The Pro Max’s extended battery life also stood out as a key selling point. Apple highlighted the base model’s enhanced features, including a brighter, scratch-resistant screen and an improved front-facing camera optimized for horizontal selfies. Despite a 6% decline in shipments during the first eight weeks of Q3, analysts remain optimistic. Chiew Le Xuan of Omdia forecasts an 11% year-over-year increase in iPhone shipments in China for the second half of 2025, driven by the new series. The iPhone 17 Pro Max, with its major redesign, is expected to outperform its predecessor and become Apple’s top-performing model in the Chinese market by 2026. Meanwhile, the iPhone Air, featuring e-SIM support, is seen as a technological testbed for future innovations, though its slim design compromises battery life and camera quality, which may limit its appeal among Chinese consumers. Apple’s ability to navigate regulatory hurdles for e-SIM services with Chinese telecom operators will also play a crucial role in its success.

-

Exclusive: FDA nicotine pouch pilot to ease manufacturers’ research burden, transcript shows

The U.S. Food and Drug Administration (FDA) has announced a significant shift in its regulatory approach to nicotine pouches, a popular smoking alternative, through a new pilot program. Internal meeting transcripts reveal that the FDA will no longer require manufacturers to conduct costly, product-specific studies to assess their impact on public health. Instead, the agency will rely on existing general research to evaluate the effectiveness and safety of these products. This move marks a departure from the FDA’s historically stringent review process, which has been a major hurdle for companies like Philip Morris International, Altria, and British American Tobacco, whose brands Zyn, On!, and Velo are expected to benefit from the pilot. The FDA’s decision aims to streamline the approval process while maintaining a focus on public health, particularly in helping smokers transition away from traditional cigarettes. However, experts have raised concerns about the potential risks, including the possibility of increased youth usage and the lack of product-specific data to ensure the safety and efficacy of individual offerings. The pilot program, while still in its early stages, could set a precedent for future regulatory changes in other nicotine product categories, such as vapes. The FDA has emphasized that the program does not lower scientific standards, but critics argue that the move may compromise public health safeguards.

-

Global economy takes Trump shocks in stride, for now

Despite a turbulent start to President Donald Trump’s tenure, marked by aggressive tariff policies and attempts to influence the Federal Reserve, the global economy has demonstrated surprising resilience. Over the past eight months, equity and bond markets have remained stable, with stock prices surging and inflation fears subdued. This stands in stark contrast to earlier predictions of economic collapse and recession during Trump’s initial months in office.

-

Australian prime minister heads to New York, may meet Trump for first time

Australian Prime Minister Anthony Albanese is set to embark on a pivotal visit to the United States this week, with expectations of a crucial meeting with President Donald Trump. The discussions are anticipated to focus on the AUKUS defense partnership and the growing influence of China in the Indo-Pacific region. Albanese will first attend the United Nations General Assembly in New York, where he is scheduled to participate in a reception hosted by Trump. Although a formal bilateral meeting has not been confirmed, Trump hinted at a forthcoming engagement with Albanese, stating that the Australian leader would visit him ‘very soon.’

The AUKUS pact, a trilateral security agreement between Australia, the United Kingdom, and the United States, is designed to counter China’s rapid naval expansion. However, the partnership is currently under review by the Pentagon, raising questions about potential new conditions. Former Australian ambassador to Washington, Arthur Sinodinos, emphasized the importance of securing Trump’s in-principle support for the nuclear-powered submarine deal to bolster investor confidence. King Charles III has also endorsed AUKUS, describing it as a ‘vital collaboration’ during Trump’s recent UK visit.

At the UN General Assembly, Albanese plans to advocate for Palestinian statehood and address Australia’s controversial law banning social media for children under 16. Both positions diverge from U.S. policies, with Trump criticizing foreign regulations he deems unfavorable to American tech companies. Despite these differences, both nations share a common goal of reducing China’s dominance in the supply of critical minerals. Over 20 Australian critical minerals companies recently met with Trump administration officials to explore collaborative opportunities.

Trade discussions will also be on the agenda, with Australia urging the U.S. to uphold a free trade agreement that benefits Washington. Australia has already secured a favorable 10% baseline tariff, the best deal offered to any country. Additionally, under U.S. pressure to increase defense spending, Australia announced an extra A$12 billion ($8 billion) to upgrade a shipyard in Western Australia for AUKUS submarine maintenance.

Australia’s strategic ties in the Pacific Islands remain a key interest for the U.S., although recent setbacks in Vanuatu and Papua New Guinea have hindered efforts to limit China’s influence. China has opposed exclusive treaties that restrict sovereign nations from cooperating with third parties, further complicating regional dynamics. Sinodinos warned that other players are capitalizing on perceived disengagement by the U.S., Australia, and New Zealand in the region.

-

Thai central bank intervenes to slow currency moves, says official

The Bank of Thailand (BOT) has stepped in to moderate the rapid appreciation of the Thai baht, which recently hit its strongest level in four years. Assistant Governor Chayawadee Chai-anant confirmed the central bank’s intervention during a press briefing on Friday, emphasizing the institution’s commitment to managing currency volatility. ‘We are closely monitoring and managing the baht’s movements, as reflected in the rise in foreign reserves,’ she stated. The baht was trading at approximately 31.86 per U.S. dollar, marking an 8% increase this year—the second-largest gain among Asian currencies, trailing only the Taiwan dollar. Chai-anant attributed the baht’s surge to a combination of factors, including a weaker U.S. dollar, Thailand’s current account surplus, gold trading activities, and political developments. She also noted that the central bank has no immediate plans to implement a gold tax, citing the need for further discussions. The BOT’s strategy remains focused on preventing excessive fluctuations in the currency, ensuring stability in the financial markets.

-

Morning Bid: BOJ holds, with a hawkish twist

As the Bank of Japan (BOJ) concluded its latest policy meeting, global markets experienced a mix of reactions. The BOJ’s decision to maintain its current interest rates was not unanimous, with two dissenting votes highlighting internal disagreements about the timing of future rate hikes. This decision, coupled with the Federal Reserve’s recent rate cut, has left investors cautiously optimistic but wary of the broader global economic outlook. BOJ Governor Kazuo Ueda’s upcoming press conference is highly anticipated, as markets seek clarity on the central bank’s rate trajectory and its plans to divest from ETFs and real estate investment trusts (REITs). The yen strengthened slightly post-decision, while Japan’s Nikkei index dipped after briefly hitting a record high. Across Asia, markets mirrored Wall Street’s gains, with Taiwan’s benchmark index reaching a new peak. European futures, however, signaled a subdued opening following a strong session on Thursday. The Bank for International Settlements (BIS) issued a warning this week, noting that soaring global stock prices seem increasingly detached from mounting concerns over government debt levels in bond markets. The U.S. dollar remained steady, though analysts predict a potential decline in the near term. With limited economic data expected from Europe, attention remains focused on interest rate dynamics and the ongoing market response to the BOJ’s decision. Additionally, European tech stocks are under scrutiny after Nvidia announced a $5 billion investment in Intel, bolstering the struggling U.S. chipmaker. Key economic events to watch include UK retail sales for August and Germany’s producer prices for the same month.

-

BOJ keeps interest rates steady, decides to start selling ETFs

The Bank of Japan (BOJ) concluded its two-day policy meeting on Friday, September 19, 2024, by maintaining its short-term interest rate at 0.5%, a decision that aligned with market expectations. However, the central bank unveiled a significant shift in its asset management strategy, announcing plans to begin selling its holdings of exchange-traded funds (ETFs) and real-estate investment trusts (REITs). This move marks a departure from its long-standing policy of accumulating these assets to stabilize financial markets. Notably, the decision was not unanimous, as board members Naoki Tamura and Hajime Takata expressed dissent. BOJ Governor Kazuo Ueda is scheduled to elaborate on the policy adjustments during a press conference at 3:30 p.m. local time (0630 GMT). The announcement comes amid ongoing efforts by the BOJ to navigate Japan’s complex economic landscape, balancing inflationary pressures with the need for sustained monetary support. Analysts are closely watching the potential market impact of the ETF and REIT sales, which could signal a gradual normalization of the BOJ’s unconventional monetary policies.