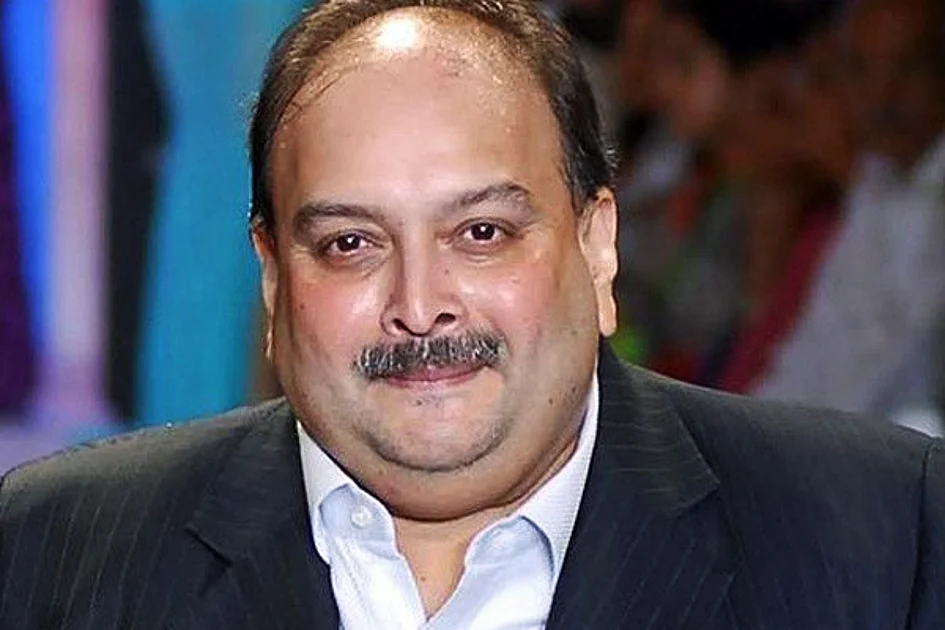

In a landmark decision, a Belgian court in Antwerp has granted India’s request for the extradition of fugitive diamond trader Mehul Choksi, marking a significant step in the ongoing Punjab National Bank (PNB) fraud case. The court ruled that Choksi’s arrest by Belgian authorities earlier this year was lawful, paving the way for his potential return to India. However, the extradition process is not immediate, as Choksi retains the right to appeal the decision before a higher court.

Choksi, along with his nephew Nirav Modi, is accused of masterminding one of India’s largest banking frauds, involving fraudulent letters of undertaking that allegedly defrauded PNB of over Rs13,000 crore. Following a formal request from Indian authorities, Choksi was arrested by Antwerp police on April 11, 2025, and has since been held in a Belgian prison. Multiple bail pleas have been rejected due to concerns over his potential flight risk.

To address human-rights concerns raised during the extradition proceedings, India’s Ministry of Home Affairs (MHA) provided a detailed letter of assurance to Belgian authorities. The document outlined specific safeguards for Choksi’s detention in India, including access to medical care, adequate living conditions, and oversight by human rights commissions. Choksi is expected to be held in Barrack No. 12 at Arthur Road Jail in Mumbai, a facility designed for non-violent offenders, equipped with modern amenities and 24×7 medical support.

The Indian government has also assured that Choksi will receive specialised medical treatment at Sir J J Group of Hospitals, with judicial and human rights oversight to ensure compliance with international standards. This ruling represents a critical development in India’s efforts to bring Choksi to justice, as he faces multiple charges under the Indian Penal Code and the Prevention of Corruption Act, 1988.