China Daily Information Co (CDIC) holds exclusive rights to all content published on its platform, encompassing text, photographs, and multimedia materials. Unauthorized republication or use of this content in any form is strictly prohibited without prior written consent from CDIC. The website is optimized for browsers with a resolution of 1024*768 or higher, ensuring an optimal user experience. Additionally, CDIC operates under the online multimedia publishing license number 0108263 and is registered under the number 130349. The platform also provides various services, including advertising opportunities, contact information, job offers, and employment resources for expatriates. Users are encouraged to follow China Daily for updates and further engagement.

博客

-

UAE businesses that ignore sustainability ‘will not survive’, says official

DUBAI – At the Care for Sustainability Mena forum, a senior UAE official delivered a stark warning to the private sector: companies treating environmental responsibility as a compliance exercise rather than a core business imperative will not survive in the evolving market landscape. Maher Al Kaabi, Independent Board Member and Advisor to Al Serkal Group and a member of the UAE Circular Economy Council, emphasized that sustainability has transitioned from optional to essential for business continuity.

Speaking during a fireside chat titled ‘The Digital Triad of UAE AI, Circular Economy, and the Future of Capital,’ Al Kaabi criticized superficial sustainability efforts designed merely to meet reporting requirements. “If you are not sustainable in doing business, you will not survive. You will not be able to stay relevant in the market,” he stated unequivocally. He stressed that authentic progress requires integrating sustainable practices into fundamental business models rather than implementing peripheral initiatives.

The two-day forum, hosted at Madinat Jumeirah and organized by Trescon, gathered over 1,000 delegates including government representatives, global investors, and decision-makers from more than 200 investment firms. The event serves as a major regional platform for advancing climate action and clean energy innovation across the Middle East and North Africa.

Al Kaabi outlined the UAE’s methodical approach to policy development, emphasizing collaboration with private sector partners to ensure competitive stability. “We do not want to make policies where we say that tomorrow you must do this, otherwise it will fail,” he explained, highlighting the government’s focus on awareness campaigns and incentives before regulatory measures. He cited the phased implementation of plastic bag charges as a successful example of this strategy.

The official also emphasized the foundational role of household education in driving environmental change. “Behaviors children learn at home shape how they see consumption and waste,” he noted, pointing to updated school curricula that now incorporate environmental responsibility.

Revealing the UAE’s long-standing commitment to circular economy principles, Al Kaabi noted that foundational work began as early as the 1990s, demonstrating leadership foresight in green growth long before it gained global prominence. He concluded that consumer demand, particularly from younger generations seeking sustainable options across all product categories, is creating undeniable market pressure for genuine business transformation.

-

Russia’s frozen assets at center of negotiations over Ukraine peace deal

The European Union (EU) faces a critical juncture in its financial support for Ukraine, with the bloc’s most viable funding mechanism hinging on the seizure of billions of dollars in frozen Russian assets. This approach has gained urgency as U.S. President Donald Trump’s 28-point peace plan proposed a $100 billion investment scheme for Ukraine’s reconstruction, financed by Russian assets matched by an equal contribution from the EU. The plan, which surprised European leaders, has sparked intense debate over the fate of Russia’s frozen fortune and its role in maintaining pressure on Moscow while bolstering Ukraine’s defense. European Commission President Ursula von der Leyen emphasized that European taxpayers alone cannot bear the financial burden, as the EU has already provided nearly $197 billion in aid since Russia’s invasion of Ukraine. The bloc is now exploring options to utilize $225 billion in Russian assets frozen at Euroclear, a Brussels-based financial institution, to cover Ukraine’s estimated $153 billion budget and military needs for 2026 and 2027. However, Trump’s proposal has raised concerns in Europe, with analysts viewing it as an attempt to secure a quick deal that benefits the U.S. at the EU’s expense. Despite initial skepticism, some European policymakers suggest that accepting the U.S. proposal might be necessary for a broader peace agreement. Meanwhile, Belgium’s reluctance to approve the use of Russian assets as collateral due to fears of Russian retaliation has added complexity to the issue. With the clock ticking, EU leaders are set to convene in Brussels on December 18 to finalize their stance on seizing Russian assets, a move that could send a strong message to Moscow and secure Ukraine’s financial future.

-

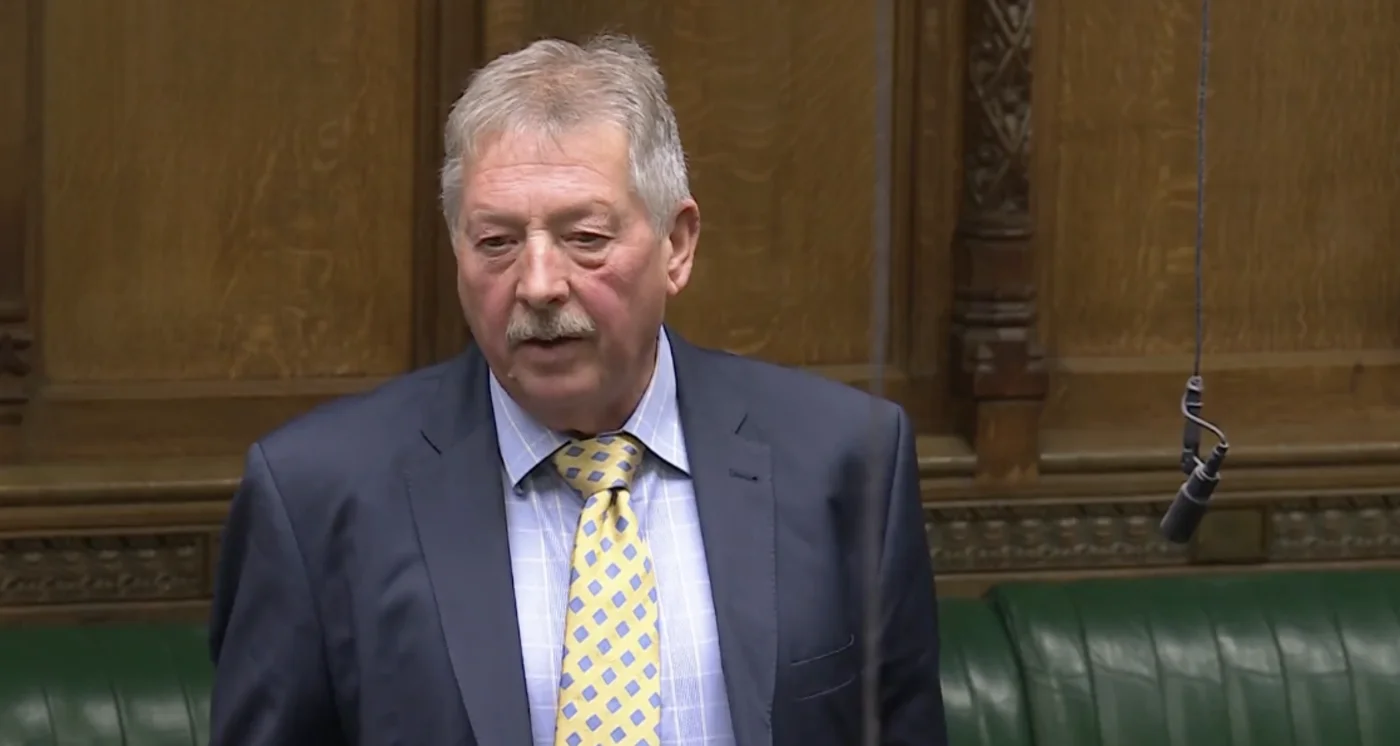

Ulster MP’s claim police caved to Muslim ‘pressure’ over Maccabi row ‘disgraceful and divisive’

A Member of Parliament has been reported to the parliamentary standards commissioner following controversial remarks alleging that West Midlands Police banned Israeli football fans from a match due to pressure from Muslim politicians and activists. The incident, which occurred during a parliamentary session on Monday, involved Democratic Unionist Party MP Sammy Wilson, who claimed that the police decision to bar Maccabi Tel Aviv supporters from a November 6 fixture at Villa Park was influenced by “Muslim politicians and Muslim thugs.

The ban, which sparked significant political backlash and was labeled as antisemitic by the British government last month, has been a contentious issue. Middle East Eye previously reported that a confidential West Midlands Police document cited Dutch police warnings about Maccabi Tel Aviv fans being “experienced fighters” and “intent on causing serious violence” during a 2024 incident in Amsterdam. However, a Sunday Times report later contradicted this, alleging that West Midlands Police exaggerated the threat, a claim the force denies.

During the parliamentary session, Wilson questioned Home Office minister Sarah Jones, accusing the police of fabricating their assessment. He argued that the decision left the Jewish community feeling marginalized and demanded an inquiry into potential political pressure on the police. Despite Wilson’s claims, there is no evidence to suggest that West Midlands Police were influenced by external political forces. Numerous MPs, including Muslim and non-Muslim representatives, supported the ban, emphasizing public safety concerns.

Independent Alliance MP Ayoub Khan, a vocal supporter of the ban, condemned Wilson’s remarks as “disgraceful, inflammatory, and deeply irresponsible” and announced plans to file a formal complaint with the standards commissioner. Former Labour leader Jeremy Corbyn echoed these sentiments, stating that the ban was not about targeting Jewish individuals but addressing extremist behavior among football fans.

In response, Home Office minister Jones emphasized the importance of public confidence in policing but refrained from commenting on the specifics of Wilson’s allegations. Labour MP Kim Johnson criticized Wilson’s comments as “reckless, baseless, and deeply divisive,” stressing that the police decision was based on evidence and public safety, not sectarian pressure.

West Midlands Police reiterated their stance, asserting that their evaluation was informed by credible intelligence and aimed at ensuring public safety. The controversy highlights broader concerns about Islamophobia and the use of divisive language in political discourse.

-

Fun City unveils four-hour triple deal takeover

In a strategic move timed with the approaching Eid Al Etihad long weekend, Middle Eastern entertainment giant Fun City has unveiled an unprecedented promotional event set for November 29, 2025. The limited-time offer, available exclusively between 8:00 AM and 12:00 PM, represents one of the most substantial value propositions in the regional family entertainment sector.

The promotion enables UAE families to acquire a comprehensive entertainment package valued at Dh1,500 for merely Dh450. This exceptional bundle includes 116 play credits redeemable across Fun City’s extensive network of arcade games, amusement rides, and interactive play zones, complemented by three premium toys. The play credits maintain validity for six months, providing extended flexibility for family entertainment planning throughout the winter season and beyond.

Accessibility remains a cornerstone of this initiative, with the offer available both at physical locations including Fun City, Fun Block, and Fun Works venues throughout the Emirates, and through the company’s official digital portal at funcityarabia.com. This dual-channel approach accommodates both in-person and online purchasing preferences.

The timing of this promotion aligns strategically with seasonal patterns, coinciding with school breaks and holiday celebrations. Industry analysts note that such aggressive pricing strategies reflect the competitive landscape of family entertainment, where established brands like Fun City leverage their scale to deliver exceptional value while maintaining quality standards.

As a recognized leader in indoor family entertainment across the Middle East, Fun City continues to demonstrate its commitment to creating affordable, memorable experiences. The current promotion not only serves as a customer acquisition tool but also reinforces brand loyalty during a period of increased discretionary spending among UAE families.

The limited four-hour availability window creates both urgency and exclusivity, elements that have proven effective in previous promotional campaigns within the entertainment sector. With the long weekend approaching, this offer presents families with a compelling alternative to traditional leisure activities while providing substantial economic advantages compared to standard pricing models.

-

Indian city of Ahmedabad to stage 2030 Commonwealth Games

The city of Ahmedabad in India has been officially selected as the host for the 2030 Commonwealth Games, marking the 100th anniversary of the inaugural event held in Hamilton, Canada. The decision was ratified during the 2025 General Assembly of the Commonwealth Sport membership in Glasgow. Ahmedabad, located in the western state of Gujarat, emerged as the chosen city following a competitive evaluation process that also included Abuja, Nigeria. This announcement underscores India’s growing prominence in the global sports arena, having previously hosted the Commonwealth Games in Delhi in 2010. The 2030 Games will not only celebrate a century of the event but also highlight Ahmedabad’s capacity to organize a major international sporting spectacle. The selection comes after the Australian state of Victoria withdrew as the original host due to financial constraints, leading Glasgow to step in for a scaled-down version of the Games in 2026.

-

Eton Solutions wins ‘Innovative Use Of AI’ Award for EtonAI at WealthBriefing MENA Awards 2025

Eton Solutions, a global leader in wealth management technology, has been honored with the ‘Innovative Use of Artificial Intelligence’ award at the WealthBriefing MENA Awards 2025. The accolade was bestowed upon the company for its groundbreaking AI-powered platform, EtonAI, during a prestigious ceremony held at the Armani Hotel in Dubai. The WealthBriefing MENA Awards celebrate organizations that exhibit exceptional innovation, industry influence, and client value, with winners selected through a rigorous, independent judging process. EtonAI, an enterprise-grade AI platform, has revolutionized wealth management by automating complex processes such as onboarding, document management, and investment research. Built on the robust AtlasFive® platform, which supports over 960 families and manages more than 21.3 million annual transactions, EtonAI enhances operational efficiency, scalability, and decision-making. Eton Solutions is also one of the few organizations globally to achieve ISO 42001 certification, underscoring its commitment to responsible and secure AI practices. Bryan Henning, SVP and Global Head of Sales and Business Development at Eton Solutions, remarked, ‘This award validates our approach to AI, demonstrating how we are reshaping wealth management by addressing real operational challenges.’ Stephen Harris, CEO of ClearView Financial Media, praised the winners, stating, ‘This recognition highlights the finest in the MENA wealth management sector and beyond.’ This achievement further solidifies Eton Solutions’ reputation as a trusted technology partner for family offices, private equity firms, and wealth managers worldwide.

-

Euro zone banks should prepare for risk of dollar squeeze, ECB says

The European Central Bank has issued a critical directive to major euro zone financial institutions, urging immediate preparation for potential U.S. dollar liquidity strains exacerbated by heightened currency volatility under the Trump administration. This warning forms the centerpiece of the ECB’s latest Financial Stability Review, which identifies unprecedented dollar squeeze scenarios as a paramount concern for European banking stability.

According to the comprehensive assessment, a select group of systemically important euro zone banks with substantial dollar-denominated operations must significantly bolster their capital reserves and liquid dollar assets. These institutions—including BNP Paribas, Deutsche Bank, Crédit Agricole, Groupe BPCE, ING, Banco Santander, and Société Générale—collectively hold approximately €681 billion in dollar securities while maintaining €712 billion in dollar-denominated lending portfolios.

The ECB’s analysis highlights several vulnerability points: stretched market valuations, escalating trade tariffs, mounting corporate debt, and the emerging risk profile of stablecoins. However, the most acute concern revolves around potential disruptions in dollar funding markets, where European banks typically secure dollar liquidity through repurchase agreements and foreign exchange swaps.

While not explicitly detailed in the official report, ECB officials have privately contemplated extreme scenarios including the Federal Reserve potentially terminating its emergency liquidity swap arrangement with the European Central Bank—a critical backstop mechanism maintained since the global financial crisis. Such an event could trigger catastrophic dollar outflows that would rapidly exhaust existing liquidity buffers.

ECB Vice President Luis de Guindos sought to downplay immediate concerns regarding swap line accessibility, emphasizing during a press conference that ‘these bilateral swap lines represent crucial mechanisms for maintaining financial stability on both sides of the Atlantic.’ His comments echoed similar reassurances recently provided by New York Fed President John Williams.

The central bank’s assessment concludes that while current dollar asset-liability mismatches remain ‘limited’ through careful maturity alignment strategies, these measures ‘do not fully eliminate liquidity risk’ during periods of severe market stress. The ECB therefore recommends that institutions maintain substantial dollar asset reserves to counterbalance potential outflows while functioning as stabilizing intermediaries in turbulent markets.

-

As AI reshapes shopping, US retailers try to change how they’re seen online

The $253 billion US holiday shopping season is undergoing a fundamental transformation as artificial intelligence reshapes consumer behavior. While traditional search engine advertising continues to dominate online sales, retailers are now aggressively adapting to the emergence of AI shopping assistants that are changing how consumers discover and purchase products.

Major corporations are implementing sophisticated strategies to capture attention within AI ecosystems. According to Brian Stempeck, CEO of generative engine optimization platform Evertune.ai, brands that previously produced three to four monthly blog posts are now generating 100-200 pieces of content specifically designed for AI discovery. His company charges approximately $3,000 monthly to help apparel and footwear clients optimize their digital presence for large language models.

The technological shift has prompted innovative approaches beyond conventional advertising. Retailers are developing specialized websites invisible to human shoppers but designed exclusively for AI scrapers—automated data extraction tools that feed product information to platforms like ChatGPT and Google’s Gemini. These AI systems then provide consumers with product comparisons, pricing analysis, and direct purchasing capabilities.

Though AI-generated traffic currently represents less than 1% of overall e-commerce activity according to Sensor Tower data, retailers recognize the emerging opportunity. Bed linen company Brooklinen has implemented a multi-faceted strategy including influencer partnerships on Facebook, YouTube, and TikTok, whose content gets scraped by AI systems. The company has also submitted products for industry awards to enhance AI visibility.

Technology giants are accelerating this transformation. Google has introduced AI shopping features that help consumers track prices and make purchases, while Amazon reports that users of its Rufus AI assistant are 60% more likely to complete purchases. Both Walmart and Target have recently announced plans for chatbot-enabled shopping applications, signaling industry-wide adoption of AI-driven commerce.

The transition presents unique challenges, particularly regarding demographic adoption. Brooklinen COO Rachel Levy notes that while Generation Z represents the most enthusiastic adopters of AI tools, their current purchasing power remains limited compared to older demographics. Nonetheless, the retail industry’s substantial investments in AI optimization indicate a fundamental belief that agentic AI will redefine consumer shopping patterns in the coming years.

-

Sonu Nigam, NE-YO announce plan to take Asian music worldwide

In a landmark development for the global music industry, Indian singing legend Sonu Nigam has partnered with American R&B superstar NE-YO, pioneering Chinese American rapper MC Jin, and veteran music executive Jonathan Serbin to establish Pacific Music Group. This innovative entertainment venture, headquartered in Hong Kong, represents a strategic initiative to revolutionize the discovery, development, and global presentation of Asian musical talent.

The newly formed company emerges against the backdrop of Asia’s rapidly expanding music landscape, which encompasses approximately 1.6 billion people domestically and substantial diaspora communities internationally. Sonu Nigam, drawing from his extensive career, emphasized the growing aspiration among Asian artists to achieve worldwide recognition: ‘Indian artists, and indeed creators across Asia, demonstrate an increasing hunger for global reach while maintaining their cultural authenticity. Through Pacific Music Group, we aim to facilitate this expansion by enabling artists to flourish both within their home markets and on the international stage.’

Pacific Music Group has been conceived as a transformative model for artist development, fundamentally rooted in Asia’s creative dynamism. The company will implement a comprehensive strategy that includes talent discovery, mentorship programs, and culturally significant collaborations. Its operational framework features a multi-genre imprint system encompassing pop, R&B, Hip-Hop, electronic music, and diverse regional Asian styles, reflecting the musical richness of the world’s fastest-growing markets.

The leadership team brings unparalleled expertise to this venture. Sonu Nigam, NE-YO, and MC Jin will provide artist guidance based on their decades of combined international success, while Jonathan Serbin, former Co-President of Warner Music Asia, contributes executive leadership shaped by his instrumental role in developing the region’s music ecosystem.

Serbin articulated the strategic vision behind the initiative: ‘Asia’s demographic and economic significance—representing half the global population and containing three of the top ten music markets—positions the region to lead the next wave of musical innovation worldwide. Pacific Music Group is designed to harness this potential and create meaningful pathways for Asian artists to achieve global impact.’

This venture signals a significant shift in music industry dynamics, potentially reshaping how cultural exchange occurs between Eastern and Western music markets while providing unprecedented opportunities for Asian artists to reach international audiences.