The US economy is navigating turbulent waters as macroeconomic indicators reveal a mix of concerning trends. While the economy is not yet in crisis, persistent inflation, sluggish job growth, and policy missteps are raising alarms. The labor market, a key pillar of economic health, is showing signs of strain. Unemployment rates are creeping up, albeit remaining historically low, and job creation has fallen short of expectations. August saw only 22,000 jobs added, far below the anticipated 75,000, marking a significant slowdown from earlier in the year.

分类: business

-

China’s EV takeover driving global supply chain revolution

China’s meteoric rise in the electric vehicle (EV) industry is no longer a domestic narrative but a global phenomenon reshaping automotive and energy supply chains. A decade ago, Chinese automakers were seen as imitators; today, they are industry leaders. BYD has surpassed Tesla in global EV sales, while companies like Nio, Li Auto, Geely, and SAIC are capturing significant market shares. Battery giant CATL has become indispensable, powering both Chinese and international brands. This transformation, initially driven by government support, has evolved into structural dominance, compelling the world to react. In 2023, China overtook Japan as the world’s largest vehicle exporter, shipping 5.2 million cars—a 70% increase from the previous year. Domestically, 31.4 million vehicles were sold, with EVs accounting for over 40% of production. Analysts predict that by 2030, China could produce 36 million cars annually, representing 40% of global output. This ascent is fueled by scale, cost control, and over $230 billion in state-backed subsidies, infrastructure, and research investments. China’s supply chain integration, lower labor costs, and vast battery ecosystem provide an unassailable advantage. The implications are profound: global auto incumbents face margin pressures, EV-linked commodities are in high demand, and trade tensions are escalating as Western governments impose tariffs to protect their markets. Yet, protectionism can only slow, not halt, China’s advance. European showrooms are increasingly filled with competitively priced Chinese EVs, and Chinese brands are gaining traction in markets like the UK and Norway. Beyond autos, the EV surge is reshaping metals markets, energy utilities, and software platforms. China’s dominance mirrors its success in solar panels, drones, and steel, driven by deliberate industrial policy. For investors, this represents both opportunities and risks, as the global automotive and energy sectors undergo a once-in-a-generation transformation. China’s EV revolution is accelerating the energy transition, reducing oil demand, and straining electricity grids. The future of mobility, energy, and manufacturing is being written in China, and the world must adapt.

-

Post-truth stats: what if US economic data can no longer be trusted?

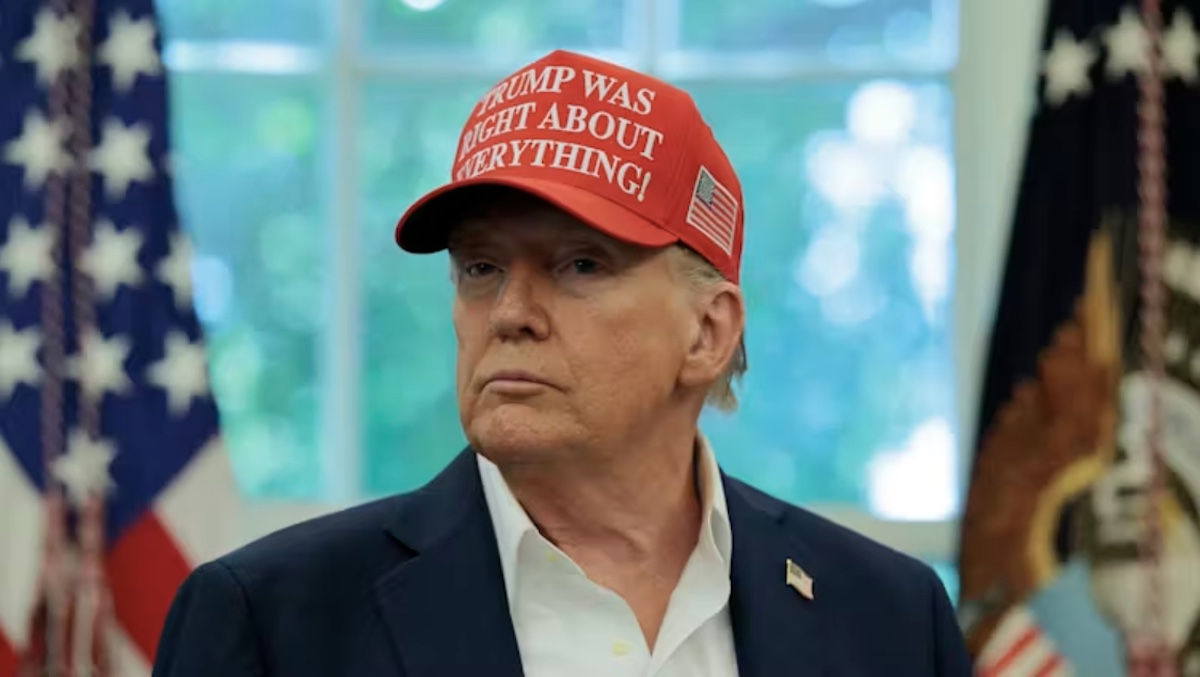

In an era increasingly defined by skepticism towards official narratives, the integrity of US economic data is now under unprecedented scrutiny. The recent actions of former President Donald Trump have cast a long shadow over the credibility of key economic indicators, raising concerns about the reliability of the nation’s statistical institutions.

-

Trump Doctrine 2.0: a half-year economic autopsy

On January 20, 2025, Donald Trump reclaimed the presidency with a bold promise of an ‘economic revolution.’ Six months into his term, the global economy is grappling with the consequences of his radical policies, which have created a bifurcated economic landscape. Traditional markets are struggling under the weight of trade wars and uncertainty, while the digital economy is experiencing unprecedented growth. This report delves into the implementation and impact of Trump’s economic agenda, revealing a mixed record of successes, failures, and suspended projects. Key initiatives such as cryptocurrency deregulation and oil production expansion have seen significant victories, while efforts to curb inflation and end the Ukraine war have faltered. The US economy is now characterized by a dual-speed dynamic: the Main Street economy faces stagnation and rising costs, while the speculative digital economy booms. This dichotomy poses significant challenges for policymakers, with the Federal Reserve caught between combating inflation and preventing recession. The long-term implications of Trump’s policies include rising national debt, increased economic inequality, and a shift toward a multipolar global order. As the world adapts to an unpredictable America, the Trump doctrine’s legacy remains uncertain, with the potential for both transformative change and systemic crisis.

-

China’s lithium mining faces strict new regulatory era

China has significantly intensified its regulatory oversight of lithium mining, transitioning from a lenient approach to a stringent framework aimed at ensuring sustainable and high-quality growth. In 2023, authorities initiated a policy to ‘clean up’ productive capacity, eliminating unlicensed operators and enforcing stricter compliance standards. This shift culminated in the enactment of a revised Mineral Resources Law in July 2025, which for the first time classified lithium as an independent, strategic mineral, thereby raising entry barriers and centralizing approval authority within the Ministry of Natural Resources (MNR).

Among the key changes, the new framework established a minimum lithium oxide (Li₂O) content of 0.4% for deposits to qualify as lithium orebodies, mandated the reclassification of mines previously registered under other categories, and reinforced environmental and safety standards through ‘green mine’ criteria. The centralization of mining rights approval aimed to curb past issues, such as in Yichun, where local officials had overstepped their jurisdiction.

The lithium industry faced significant challenges in 2023, with prices plummeting nearly 90% due to oversupply and slowing demand. This downturn led to fierce competition and overcapacity, forcing smaller, high-cost mines to operate at a loss. By mid-2025, around 30% of Jiangxi’s lithium-mica capacity remained idle due to negative margins.

In response, policymakers adopted ‘supply-side reform’ strategies, encouraging industry consolidation and curbing excess capacity. Measures included banning below-cost sales, adding lithium to the stabilization list of new energy materials, and coordinating temporary shutdowns in lithium-rich provinces. The Lithium Branch of the China Nonferrous Metals Industry Association also urged the supply chain to resist ‘vicious competition’ and promote healthy development.

The regulatory overhaul highlighted China’s shift from maximizing production volume to prioritizing quality, efficiency, and sustainability. Inspections in Yichun uncovered irregularities, leading to the suspension of non-compliant mines and stricter licensing procedures. This transition has bolstered lithium carbonate prices and fostered expectations of more disciplined supply.

China’s new approach aims to filter speculative or obsolete capacity, reduce domestic oversupply, and establish a technologically advanced production ecosystem. By raising entry barriers and compliance costs, the country seeks to reinforce its global leadership in lithium production on a more robust foundation.

-

China’s playbook for 90-day trade truce with US

The United States and China have agreed to extend their trade truce by 90 days, providing both nations with additional time to restructure their supply chains in anticipation of potential negotiations collapsing in November. This decision follows an executive order signed by US President Donald Trump on Monday, which postponed the implementation of higher tariffs on Chinese goods until November 10. In response, China’s Ministry of Commerce (MOFCOM) announced a reciprocal suspension of additional tariffs on US goods for the same period. Both countries will maintain existing 10% tariffs on each other’s goods, though the US will continue to impose higher tariffs on specific Chinese products, including those related to alleged fentanyl trafficking, which can reach up to 55%. Additionally, China has extended the suspension of measures under its Unreliable Entity List Working Mechanism, which was initially issued in April, affecting 17 US entities. The extension of the truce was anticipated, as US Treasury Secretary Scott Bessent had previously hinted at a 90-day extension in late July. The ongoing trade tensions have led Chinese manufacturers to explore relocating their operations to countries like Vietnam to circumvent tariffs, a strategy that has created new challenges and opportunities in global trade dynamics. Despite the temporary easing of tensions, both nations remain cautious, with further negotiations expected in the coming months.

-

Trump’s tariff paradox is making China great again

Donald Trump’s aggressive tariff policies, initially aimed at restoring American economic dominance, have instead triggered a series of unintended consequences. Rather than weakening China’s global position, these tariffs have created economic headwinds domestically, strained key alliances, and provided Beijing with opportunities to expand its influence. The average US tariff rate has surged to 18%, the highest since the 1930s, with projections indicating that US households will bear an additional $2,400 in costs by 2025. This has led to higher prices across consumer goods, from electronics to clothing. Despite a tripling of monthly tariff revenues to $29 billion by July 2025, the Congressional Budget Office warns that supply chain disruptions and rising prices will ultimately hinder economic growth. US GDP growth has already slowed to 1.2% in the first half of 2025, down from 2.8% in 2024, with manufacturing job growth stagnating and trade-related sectors suffering significant losses. California alone is projected to lose over 64,000 jobs in trade and logistics, while the Port of Los Angeles operates at just 70% capacity due to declining trade volumes. These domestic pressures have broader strategic implications, as allies and competitors alike recalibrate their relationships with an increasingly unpredictable Washington. The tariff strategy has complicated alliance relationships, with Japan and South Korea accepting modified terms to reduce tariffs to 15%, while India continues to face the full 25% tariff, leading to diplomatic tensions. This fractured alliance structure has created openings for China to offer more attractive economic incentives, positioning itself as a more stable and pragmatic partner. China has capitalized on these shifting dynamics, accelerating its dominance in clean energy technology and expanding its engagement with the Global South. Beijing’s $9 billion investment credit line to Latin America and its deepening partnerships across Africa underscore its growing influence. The US’s continued dependence on Chinese supply chains, particularly in rare earths and critical minerals, further limits its ability to confront Beijing effectively. In essence, Trump’s tariff strategy, while generating short-term revenue, risks accelerating the very shift toward Chinese centrality in the global economy that it was designed to prevent.

-

China moves to stop price wars in ‘anti-involution’ push

In response to a year-on-year decline in industrial profits across various sectors in the first half of the year, the Chinese government has initiated a nationwide campaign to prevent companies from engaging in ‘cutthroat’ pricing practices. The Politburo of the Chinese Communist Party (CCP) Central Committee, during a meeting on July 30, emphasized the need to deepen the construction of a unified national market, optimize market competition order, and regulate disorderly competition through laws and regulations. The Politburo also proposed measures to boost consumption, cultivate new growth points for service consumption, and expand commodity consumption. This decision follows the National Statistics Bureau’s report on July 27, which revealed a 1.8% decline in industrial profits to 3.44 trillion yuan (US$473 billion) in the first six months of the year. State-owned enterprises (SOEs) experienced a 7.6% drop in profits, while joint-stock companies saw a 3.1% decrease. Foreign companies in mainland China, Hong Kong, Macau, and Taiwan reported a 2.5% increase in profits, while private firms saw a 1.7% rise. The campaign aims to address ‘neijuan,’ or involution, characterized by price wars due to low demand, high inventory, excessive production capacity, and over-competition. Economists attribute the profit decline to weak domestic consumption, a sluggish property market, and the impact of US-China tariff wars. The government’s efforts include encouraging mergers and acquisitions, restructuring, and controlling new production capacity in traditional industries while supporting innovation in emerging sectors.

-

US stocks slip following the latest discouraging signal on the economy

U.S. stock indices experienced a downturn on Tuesday, reflecting growing concerns over the health of the U.S. economy. The S&P 500 dropped by 0.5%, the Dow Jones Industrial Average fell by 61 points (0.1%), and the Nasdaq composite declined by 0.7%. This movement followed a volatile period where the S&P 500 swung from its worst day since May to its best day in the same month. A weaker-than-expected report on U.S. services sector activity, encompassing industries like transportation and retail, exacerbated worries that President Donald Trump’s tariffs might be negatively impacting the economy. However, optimism surrounding potential Federal Reserve interest rate cuts and stronger-than-anticipated corporate earnings helped mitigate the losses. The S&P 500 remains within 1.4% of its record high. Edgewell Personal Care, the parent company of Schick, Playtex, and Banana Boat, saw its shares plummet by 18.8% after reporting lower-than-expected quarterly profits and revenue. CEO Rod Little attributed the decline to a weak sun care season in North America and tariff-related profit pressures. Across industries, companies have been vocal about the adverse effects of tariffs on their earnings, with trade policy emerging as a dominant theme in the latest Institute for Supply Management survey. Despite these challenges, the artificial intelligence sector continues to thrive. Palantir Technologies surged 7.8% after exceeding profit expectations and raising its full-year revenue forecast. Similarly, Axon Enterprise, known for its Tasers and body cameras, leaped 16.4% due to robust AI-driven growth. On the downside, American Eagle Outfitters fell 9.5%, partially reversing its previous day’s gains, while Yum Brands dropped 5.1% after missing earnings expectations. The S&P 500 closed at 6,299.19, the Dow at 44,111.74, and the Nasdaq at 20,916.55. Market analysts are now closely watching corporate earnings and potential Federal Reserve rate cuts in September, which could provide a boost to both stock prices and the broader economy. Treasury yields also declined, with the 10-year yield dropping to 4.19%, reflecting investor caution. Internationally, stock markets in Europe and Asia mostly rose, while India’s Sensex dipped 0.4% amid U.S.-India trade tensions.

-

US willfully ceding the energy innovation race to China

During the Cold War, the United States and the Soviet Union were engaged in a fierce competition to develop advanced technologies such as long-range missiles and satellites. Today, the global technological race has shifted to artificial intelligence (AI) and next-generation energy solutions. While the US has maintained a significant lead in AI, its position in the energy sector has been undermined by political decisions rather than technological or economic factors. Since returning to the White House in January, Donald Trump has prioritized the fossil fuel industry, rolling back support for renewable energy and appointing former industry lobbyists to key political positions. This shift has had profound implications for both domestic energy costs and the global clean energy race. The Trump administration’s policies have led to increased household energy expenses, with projections indicating a rise of $170 annually until 2035 due to the One Big Beautiful Bill Act. This legislation has stripped away incentives for renewable energy, making clean energy development more cumbersome. Meanwhile, China has surged ahead, dominating the global market for wind, solar, and next-generation batteries. China’s strategic investments in renewable energy have positioned it as a leader in electric vehicle production and solar panel manufacturing. The US, despite its potential for innovation in geothermal and battery recycling technologies, has effectively withdrawn from the competition to become the world’s 21st-century energy manufacturing powerhouse. The environmental and financial costs of Trump’s fossil fuel-centric policies are becoming increasingly evident, with climate change exacerbating natural disasters across the country. As the US grapples with rising energy costs and environmental challenges, China’s foresight in embracing renewable energy offers a stark contrast to America’s current trajectory.