The US housing market continues to grapple with affordability issues, even as mortgage rates have recently seen a modest decline. Aileen Barrameda, a prospective homebuyer in Los Angeles, remains undeterred by stubbornly high mortgage rates, which are double what she secured at the start of the COVID-19 pandemic. ‘If I have the means to get in the market, I might as well do it now because homes are just going to get more expensive,’ she said. Housing costs remain a critical concern for Americans and a focal point in political discourse. President Donald Trump had previously expressed hope that Federal Reserve interest rate cuts would ease mortgage burdens. Last week, the average rate on a 30-year mortgage, the most popular home loan in the US, fell to 6.35%, marking the largest weekly decline in the past year and the lowest level in 11 months, according to Freddie Mac. However, despite the Federal Reserve’s recent rate cut, borrowing costs are unlikely to decrease significantly further. The Fed’s decisions indirectly influence mortgage rates by affecting interbank lending rates, which in turn impact consumer loan and savings rates. Banks had already anticipated the Fed’s move, leading to preemptive mortgage rate cuts, leaving little room for further reductions. Fed Chair Jerome Powell acknowledged that significant rate changes would be necessary to substantially impact the housing sector, though lower rates could boost demand and support builders. Rising inflation risks could also push mortgage rates higher if banks expect the Fed to halt further rate cuts. Nicole Stewart, a Redfin real estate agent in Boise, Idaho, noted that the recent rate decline has spurred some buyer activity, but the market remains unaffordable for many. Many homeowners locked in historically low rates during the pandemic, around 3%, and are reluctant to sell, reducing housing supply and driving up prices. Julia Fonseca, an associate finance professor at the University of Illinois Urbana-Champaign, highlighted that roughly 80% of mortgage borrowers have rates below the current average, limiting the impact of recent declines. Kristin Carlson, a first-time buyer in Boise, has been monitoring the market for four years and sees the recent rate dip as a step closer to purchasing. However, she remains cautious, balancing borrowing costs with other factors like seasonality and finding the right home. Matt Vernon, head of consumer lending at Bank of America, described the market as cautiously optimistic but still strained. ‘The dip in rates has certainly got buyers’ attention, but it hasn’t necessarily changed their perception of the challenges,’ he said.

分类: business

-

Rwanda’s economic growth slows in Q2 2025

KIGALI, Sept 17 (Reuters) – Rwanda’s economic expansion decelerated in the second quarter of 2024, primarily due to subdued performances in the industrial and services sectors, according to the national statistics office. The economy grew by 7.8% year-on-year during this period, a notable decline from the 10.2% growth recorded in the same quarter of the previous year. The statistics office highlighted that industrial output increased by 7%, a significant drop from the 13% growth seen in the second quarter of 2023. Similarly, the services sector expanded by 9%, down from 12% in the same period last year. In contrast, the agricultural sector showed resilience, growing by 8% compared to 4% in the previous year. Rwanda’s economy, heavily reliant on agriculture, tourism, and manufacturing, faces challenges as global economic uncertainties and domestic factors weigh on key sectors. Analysts suggest that targeted policy interventions may be necessary to sustain growth momentum in the coming quarters.

-

Exclusive: Adani-led Sri Lanka container terminal to double capacity ahead of deadline

The Adani Group, in collaboration with its partners, is advancing the expansion of the $840 million Colombo West International Terminal in Sri Lanka, aiming to double its capacity by late 2026, ahead of the original schedule. This development comes despite the group’s decision to withdraw a $553 million funding request from the U.S. International Development Finance Corp, opting instead to finance the project through internal resources. The terminal, strategically located next to a facility operated by China Merchants Port Holdings, highlights Sri Lanka’s pivotal role in the geopolitical competition for influence in the Indian Ocean between India and China. The first phase of the fully automated terminal became operational in April, with the second phase now underway. Zafir Hashim, head of transportation at John Keells Holdings, a key partner, revealed that the project is progressing three to four months ahead of the February 2027 deadline. Upon completion, the terminal will handle 3.2 million containers annually, significantly boosting Colombo’s port throughput. The majority of the terminal’s business originates from India. Despite controversies, including allegations of bribery against Adani Group Chairman Gautam Adani—which the group has denied—Hashim expressed confidence in the partnership, stating that Adani has been a reliable collaborator. Adani Ports and Special Economic Zone holds a 51% stake in the terminal, with John Keells owning 34% and the Sri Lanka Ports Authority holding the remainder. Sri Lanka is also exploring further renewable energy investments with Adani, despite earlier disagreements over wind power projects. In February, Adani withdrew from two proposed $1 billion wind projects after the Sri Lankan government sought to renegotiate power purchase rates. However, the group later showed renewed interest by purchasing bid documents for smaller wind projects, signaling potential future collaborations.

-

Fed Reserve cuts interest rates but cautions over stalling job market

In a significant move reflecting growing concerns over the U.S. economy, the Federal Reserve announced a 0.25 percentage point reduction in its key lending rate on Wednesday, bringing the target range to 4%-4.25%. This marks the first rate cut since December 2022 and signals the potential for further reductions in the coming months. The decision, supported by 11 of the 12 voting members of the Federal Open Market Committee, underscores the central bank’s response to a weakening labor market and broader economic risks. Federal Reserve Chair Jerome Powell emphasized that while unemployment remains low at 4.3%, downside risks in the job market have become increasingly apparent. The move contrasts with the Fed’s July assessment, which described the labor market as ‘solid.’ Stephen Miran, a temporary member with ties to the White House, notably advocated for a more aggressive 0.5 percentage point cut. The decision comes amid persistent political pressure from President Donald Trump, who has repeatedly criticized the Fed for its reluctance to lower rates. Trump has accused Powell of stifling economic growth and even threatened to remove him from his position. Despite the political backdrop, analysts argue that the Fed’s decision was driven by economic fundamentals rather than presidential influence. Inflation, which surged post-pandemic, has moderated significantly, while job growth has stalled, with the U.S. reporting minimal gains in August and July and a net loss in June—the first since 2020. Economists predict further rate cuts, with Wells Fargo forecasting a 0.75 percentage point reduction by year-end. However, the Fed remains divided on future policy, with seven members opposing additional cuts and one advocating for rates below 3%. Powell acknowledged the complexity of the current economic landscape, stating, ‘There are no risk-free paths right now.’ The Fed’s independence has also come under scrutiny, as Trump’s administration has sought to influence its decisions through personnel changes and legal battles. Critics warn that such actions threaten the central bank’s autonomy, a cornerstone of its credibility. Despite the political drama, the Fed’s latest move is seen as a necessary step to address economic headwinds and support borrowing costs across the nation.

-

Nissan seeks to learn from Chinese supplier strategies as part of cost-cutting drive

Nissan Motor Co Ltd is intensifying its efforts to enhance cost efficiency by studying the practices of Chinese suppliers and integrating their methods into its global operations. The Japanese automaker aims to reduce variable costs by 250 billion yen ($1.71 billion) as part of a broader efficiency initiative, according to Tatsuzo Tomita, Nissan’s chief of total delivered cost transformation. Tomita highlighted the effectiveness of Chinese suppliers in utilizing standardized parts and fostering close collaboration with designers, practices that Nissan is now exploring for its current and future vehicle parts. This strategic move is part of Nissan’s ongoing turnaround plan, which includes cutting approximately 20,000 jobs and consolidating seven plants. The company has set an ambitious target of achieving 500 billion yen in cost reductions by March 2027, with half expected to come from fixed costs and the remainder from variable costs. The initiative aims to secure operating profit and positive free cash flow in Nissan’s automotive business by the same deadline. Following the announcement, Nissan’s shares rose by 1.6%, reaching their highest level since late May. Tomita emphasized that the company is not reducing its supplier base but rather strengthening collaboration. He noted that Chinese suppliers are expanding globally, with operations in Hungary, Morocco, and Turkey, and are being considered as potential partners in Nissan’s international strategy. While acknowledging the significant challenge of the 250 billion yen variable cost reduction target, Tomita expressed confidence in achieving it by maintaining the current momentum and sourcing innovative ideas from employees. The impact of these cost-saving measures is expected to become more apparent by the end of this year or next year, varying across different vehicle models.

-

African manufacturers in last-ditch bid to extend US trade programme

African manufacturers are intensifying efforts to secure a temporary extension of the African Growth and Opportunity Act (AGOA), a pivotal trade initiative set to expire at the end of September. Pankaj Bedi, chairman of United Aryan, a Kenyan apparel company supplying major U.S. retailers like Target and Walmart, revealed that delegations from Kenya and four other AGOA beneficiary nations recently visited Washington to lobby for a one- to two-year extension. The program, established in 2000 under President Bill Clinton, grants duty-free access to the U.S. market for thousands of African products, fostering economic development and job creation across sectors such as textiles, automotive, and mining. However, the aggressive tariff policies of former President Donald Trump have cast uncertainty over its renewal. Despite bipartisan support, last year’s attempt to extend AGOA for 16 years failed to reach a Congressional vote. Bedi emphasized that without an extension, manufacturers face steep tariff hikes, potentially leading to mass layoffs and a shift in U.S. reliance back to Asian manufacturers, particularly China. The White House has yet to publicly endorse an extension, leaving the future of AGOA in limbo.

-

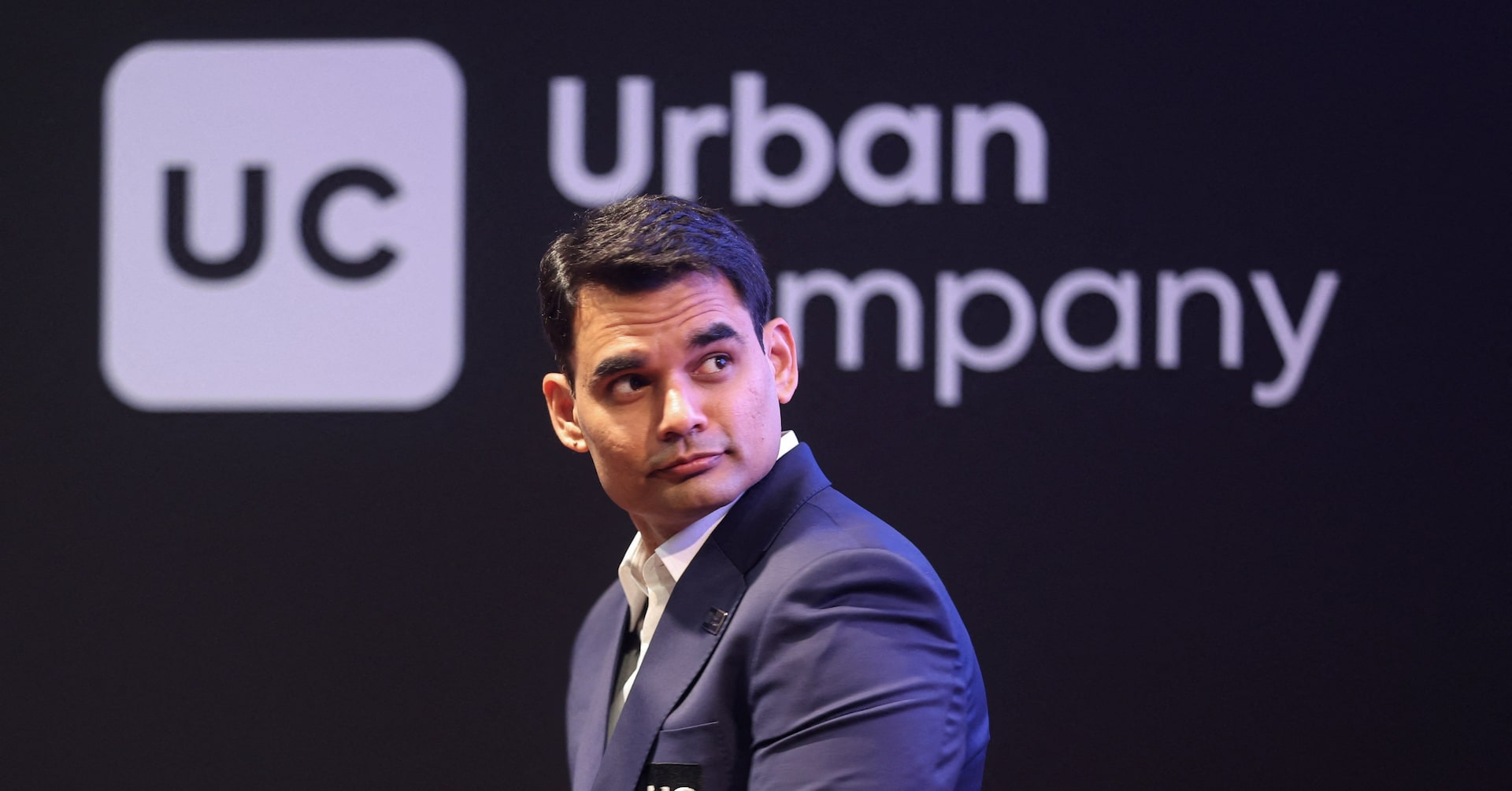

India’s Urban Company soars 74% in trading debut, hits about $3 billion valuation

Urban Company Limited, a leading player in India’s home-services sector, made a spectacular debut on the National Stock Exchange (NSE) on September 17, 2025. The company’s shares surged by 74%, catapulting its valuation to nearly $3 billion. This marked one of the most successful initial public offerings (IPOs) of 2025, with the issue being oversubscribed by a staggering 103.65 times, attracting bids worth approximately $13 billion. Urban Company’s stock opened at a 57.5% premium to its issue price, far exceeding analysts’ predictions of a 40%-51% upside. The shares hit a high of 179 rupees during the trading session and closed at 166.8 rupees, up 62% from the issue price. The IPO’s success underscores investor confidence in Urban Company’s dominance of India’s largely unorganized home-services market, which is projected to grow at a compound annual growth rate of 22.4% from 2023 to 2030, according to Grand View Research. Aishvarya Dadheech, founder of Fident Asset Management, noted that the enthusiasm reflects Urban Company’s position as a long-term play on digital adoption and rising demand for home services. The listing also coincided with a broader uptick in Indian equities, buoyed by optimism surrounding U.S.-India trade talks. The blue-chip Nifty 50 index has risen 7% in 2025 but remains 4% below its record levels from a year ago. Urban Company’s debut is a testament to the resilience and growth potential of India’s IPO market, which has rebounded after a slow start to the year and is on track to set new fundraising records.

-

Exclusive: Japan’s JERA in advanced talks to buy $1.7 billion of US shale gas assets, sources say

Japan’s leading power generator, JERA Co., Inc., is in advanced negotiations to acquire natural gas production assets in the United States for approximately $1.7 billion, according to sources familiar with the matter. This move underscores Japan’s strategic efforts to secure energy resources amid global market volatility and rising demand. The assets in question are owned by GEP Haynesville II, a joint venture between Blackstone-backed GeoSouthern Energy and pipeline operator Williams Companies. JERA has emerged as the top bidder, outpacing several U.S.-based energy firms, though the deal remains subject to finalization. This acquisition would mark JERA’s first venture into shale gas production, granting the world’s largest liquefied natural gas (LNG) buyer greater control over its supply chain. The deal aligns with Japan’s broader strategy to diversify energy sources, particularly in light of Russia’s invasion of Ukraine, which disrupted global energy markets. Additionally, the U.S.-Japan trade agreement, finalized earlier this month, commits Japan to $7 billion in annual energy purchases from the U.S., further bolstering bilateral energy ties. GEP Haynesville II, a major producer in the Haynesville shale basin spanning Texas and Louisiana, is expected to nearly double its output by 2028, according to Rystad Energy. The Haynesville basin’s proximity to LNG export facilities on the U.S. Gulf Coast has made it a highly sought-after asset. While JERA declined to comment, the potential acquisition highlights Japan’s growing reliance on U.S. energy resources to meet its domestic needs and support its technological advancements, including the AI-driven surge in data center power demand.

-

Uganda to cut public spending, domestic borrowing in 2026/27 FY

Uganda has unveiled plans to reduce its overall spending by 4.1% in the 2026/27 financial year, according to a Ministry of Finance document released on Wednesday. The East African nation projects its public expenditure for the 12 months starting July 2026 at 69.4 trillion Ugandan shillings ($19.9 billion), a decrease from 72.4 trillion shillings in the previous fiscal year. The government also aims to cut domestic debt issuance by 21.1%, lowering it to 9 trillion shillings, to manage interest payments and maintain sustainable debt levels. Key priorities for the upcoming fiscal year include completing the East African Crude Oil Pipeline (EACOP) to initiate crude oil production, advancing mineral quantification for iron ore, gold, and copper deposits, and continuing the development of a refinery and the standard gauge railway project. These measures reflect Uganda’s strategic focus on infrastructure development while ensuring fiscal discipline.

-

South African inflation surprise makes Thursday’s rate decision a close call

In a surprising turn of events, South Africa’s inflation rate for August 2024 fell to 3.3%, undershooting the 3.6% forecast by economists. This decline, attributed to softer fuel and food prices, has sparked speculation that the South African Reserve Bank (SARB) might implement another interest rate cut during its upcoming policy meeting on Thursday. The SARB has already reduced rates three times this year, with the latest cut in July, when it set a new inflation target of 3%. Prior to the release of the inflation data, the consensus was that the central bank would maintain the repo rate at 7%. However, the unexpected drop in inflation, coupled with falling bond yields and a stronger rand, has led some analysts to predict a 25 basis point cut. Razia Khan, chief economist for Africa and the Middle East at Standard Chartered, described the inflation release as a ‘game changer,’ suggesting that the September meeting could be pivotal. While some analysts remain cautious, citing potential price shocks from recent tariffs imposed by the U.S. on South African exports, others argue that a flagging economy provides additional justification for easing monetary policy. The SARB has acknowledged that the impact of these tariffs on growth and inflation could be modest, but this has yet to be reflected in official data. The central bank’s decision will be closely watched as it seeks to balance inflation control with economic stimulation.