China is rapidly emerging as the future dominant force in global publishing, with projections indicating it will become the world’s most influential publishing market within the coming decade. This remarkable ascent is fueled by multiple strategic advantages including substantial domestic market growth, targeted expansion policies, significant advancements in scholarly publishing, and pioneering adoption of digital technologies that are reshaping how content is created, distributed, and consumed worldwide.

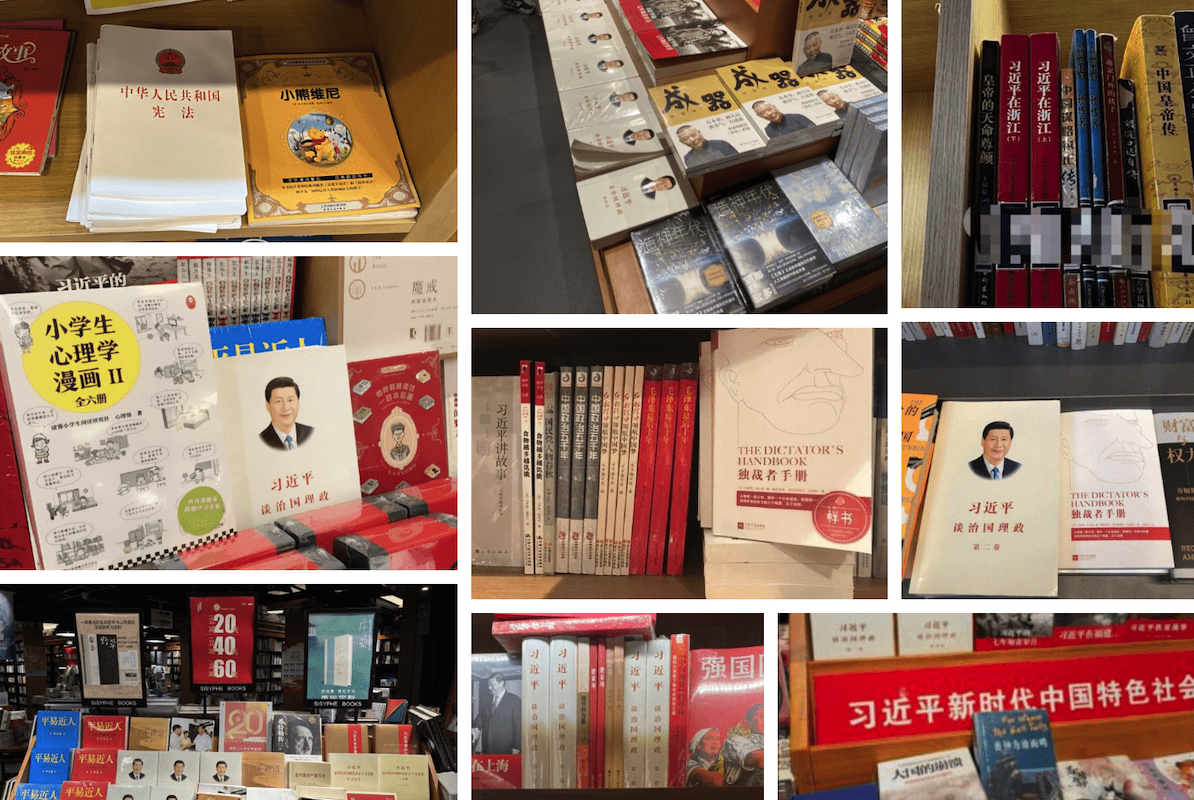

The Chinese publishing market already ranks among the world’s largest, supported by hundreds of millions of active readers with increasing disposable income driving demand across both print and digital formats. Major platforms including Dangdang and JD Books continue expanding their catalogues while audiobook and mobile reading applications gain substantial traction. Notably, physical bookstores continue to thrive alongside digital platforms, demonstrating the market’s remarkable diversity and breadth.

This robust consumer activity provides Chinese publishers with unprecedented financial flexibility to experiment with innovative formats, marketing approaches, and distribution channels. This experimentation allows them to develop and refine business models that other markets struggle to implement effectively. Despite challenges including intense price competition and demographic shifts affecting children’s book segments, China’s publishing industry maintains strong innovative capacity.

Chinese publishers are demonstrating exceptional agility in adapting to the digital landscape, with short-video e-commerce platforms like Douyin becoming significant sales channels. This rapid adoption of new retail models gives Chinese publishers distinct advantages over Western counterparts in reaching digitally-native audiences. Additionally, growing cultural pride is driving demand for high-quality original content that blends traditional Chinese narratives with contemporary themes, resulting in increased success for home-grown intellectual property and international copyright exports.

The internationalization of Chinese trade publishing forms a crucial component of government-backed soft power strategy, aligned with China’s national goal of becoming a ‘cultural powerhouse’ by 2035. Major state-owned conglomerates including China Publishing Group Corporation and China International Publishing Group are executing this strategic vision through substantial resource allocation. Organizations such as Foreign Languages Press and New World Press publish works in multiple languages covering contemporary Chinese society, literature, and cultural classics, distributed across over 180 countries through exports, co-publishing arrangements, and partnership initiatives.

Concurrently, China’s academic publishing sector is undergoing transformative growth. Massive investment in research and development has established China as a scientific and technological leader, evidenced by surpassing the United States in highly-cited academic papers. Policy shifts encouraging open access, data sharing, and transparent research practices complement substantial STEM investments. By 2030, Chinese academic publishers are projected to hold significantly increased global influence, particularly in engineering, medicine, and environmental science.

The Chinese government actively promotes creation of world-class domestic academic journals to reduce foreign dependency, accelerated by massive digital publishing investments. Initiatives like the Belt and Road Initiative include cultural components such as translation projects, reading festivals, and academic exchanges that build relationships with emerging markets. These partnerships frequently result in co-published titles and distribution agreements that position Chinese content in new markets while encouraging international collaboration.

China’s publishing sector has reached a critical juncture where ambition and capability converge, combining vast market scale, technological investment, and long-term cultural strategy to create momentum unmatched by global competitors. Within the next decade, this powerful combination will fundamentally reshape how stories are produced, research is shared, and cultural influence transcends borders. The question for global publishers is no longer whether this transformation will occur, but how rapidly they can adapt to the new publishing landscape China is creating.