Israeli Prime Minister Benjamin Netanyahu is reportedly contemplating a significant escalation in the ongoing conflict, including a full occupation of the Gaza Strip. This potential move has sparked strong opposition from senior military officials within Israel, as well as mounting international criticism over the worsening humanitarian crisis in Gaza. Despite this, Netanyahu is expected to propose the plan to his cabinet, aiming to seize the remaining areas of the strip not under Israeli control, including regions where hostages are believed to be held. While a majority of Israelis desire an end to the war and the safe return of hostages, some are hopeful for the possibility of resettling Gaza. Netanyahu’s decision, though not necessarily aligned with the settlers’ motives, could lead to similar outcomes on the ground. Historically, Israeli governments have justified settlement expansions under security pretexts, leading to the establishment of military outposts that eventually became civilian settlements. The Gaza Strip was first occupied by Israel during the Six-Day War in 1967, and over time, Israeli settlements grew, creating stark disparities with the Palestinian population. The 2005 disengagement plan, which saw the evacuation of all Israeli settlements from Gaza, marked a significant shift in policy. However, recent calls from settler groups for the resettlement of Gaza, coupled with the inclusion of influential settler leaders in Netanyahu’s cabinet, suggest a potential return to such policies. The international community remains watchful as the situation unfolds.

标签: Asia

亚洲

-

Did the 12-day war forever change Iran’s Khamenei?

In the aftermath of Israel’s 12-day military campaign against Iran, Supreme Leader Ayatollah Ali Khamenei has largely retreated from public view, sparking widespread speculation about his health and the future direction of the Islamic Republic. The conflict, which saw extensive Israeli and U.S. strikes on Iranian targets, resulted in over 1,000 casualties, including top military commanders and nuclear scientists. This unexpected assault has left Iran grappling with its most significant challenges since the Iran-Iraq War of the 1980s.

-

Trump’s tariff paradox is making China great again

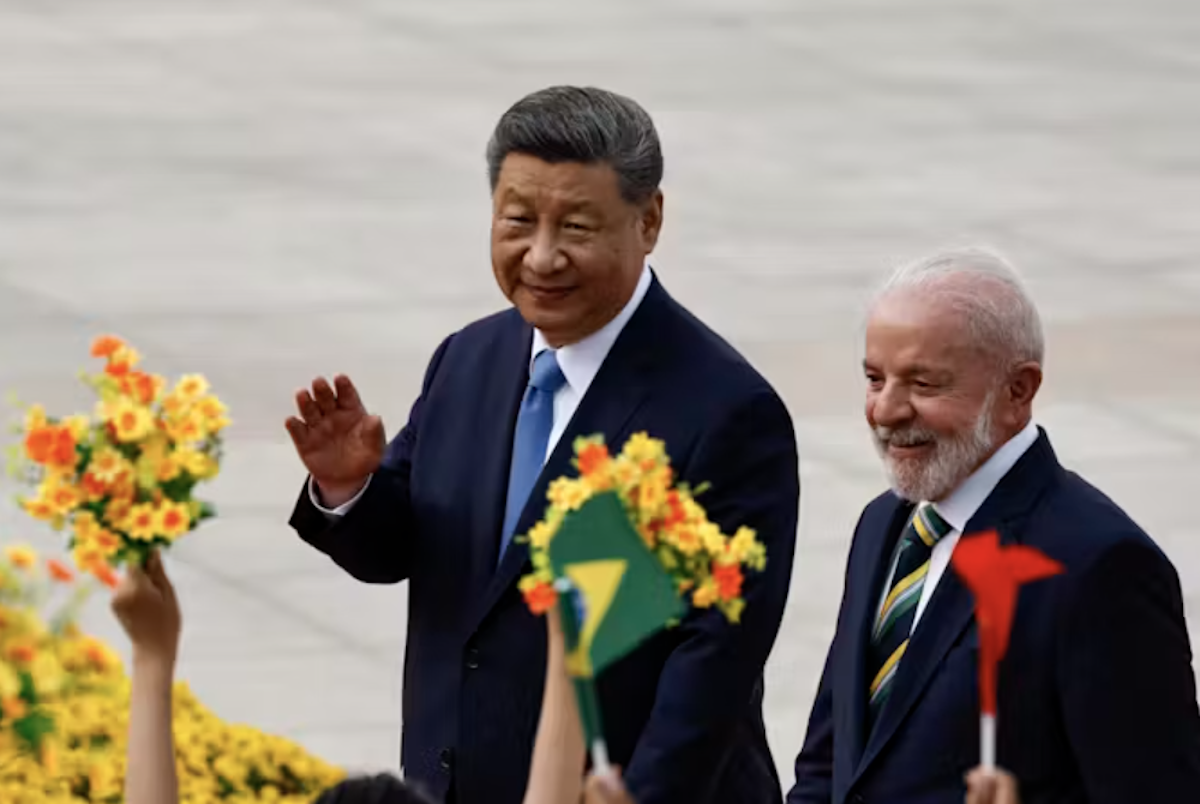

Donald Trump’s aggressive tariff policies, initially aimed at restoring American economic dominance, have instead triggered a series of unintended consequences. Rather than weakening China’s global position, these tariffs have created economic headwinds domestically, strained key alliances, and provided Beijing with opportunities to expand its influence. The average US tariff rate has surged to 18%, the highest since the 1930s, with projections indicating that US households will bear an additional $2,400 in costs by 2025. This has led to higher prices across consumer goods, from electronics to clothing. Despite a tripling of monthly tariff revenues to $29 billion by July 2025, the Congressional Budget Office warns that supply chain disruptions and rising prices will ultimately hinder economic growth. US GDP growth has already slowed to 1.2% in the first half of 2025, down from 2.8% in 2024, with manufacturing job growth stagnating and trade-related sectors suffering significant losses. California alone is projected to lose over 64,000 jobs in trade and logistics, while the Port of Los Angeles operates at just 70% capacity due to declining trade volumes. These domestic pressures have broader strategic implications, as allies and competitors alike recalibrate their relationships with an increasingly unpredictable Washington. The tariff strategy has complicated alliance relationships, with Japan and South Korea accepting modified terms to reduce tariffs to 15%, while India continues to face the full 25% tariff, leading to diplomatic tensions. This fractured alliance structure has created openings for China to offer more attractive economic incentives, positioning itself as a more stable and pragmatic partner. China has capitalized on these shifting dynamics, accelerating its dominance in clean energy technology and expanding its engagement with the Global South. Beijing’s $9 billion investment credit line to Latin America and its deepening partnerships across Africa underscore its growing influence. The US’s continued dependence on Chinese supply chains, particularly in rare earths and critical minerals, further limits its ability to confront Beijing effectively. In essence, Trump’s tariff strategy, while generating short-term revenue, risks accelerating the very shift toward Chinese centrality in the global economy that it was designed to prevent.

-

China moves to stop price wars in ‘anti-involution’ push

In response to a year-on-year decline in industrial profits across various sectors in the first half of the year, the Chinese government has initiated a nationwide campaign to prevent companies from engaging in ‘cutthroat’ pricing practices. The Politburo of the Chinese Communist Party (CCP) Central Committee, during a meeting on July 30, emphasized the need to deepen the construction of a unified national market, optimize market competition order, and regulate disorderly competition through laws and regulations. The Politburo also proposed measures to boost consumption, cultivate new growth points for service consumption, and expand commodity consumption. This decision follows the National Statistics Bureau’s report on July 27, which revealed a 1.8% decline in industrial profits to 3.44 trillion yuan (US$473 billion) in the first six months of the year. State-owned enterprises (SOEs) experienced a 7.6% drop in profits, while joint-stock companies saw a 3.1% decrease. Foreign companies in mainland China, Hong Kong, Macau, and Taiwan reported a 2.5% increase in profits, while private firms saw a 1.7% rise. The campaign aims to address ‘neijuan,’ or involution, characterized by price wars due to low demand, high inventory, excessive production capacity, and over-competition. Economists attribute the profit decline to weak domestic consumption, a sluggish property market, and the impact of US-China tariff wars. The government’s efforts include encouraging mergers and acquisitions, restructuring, and controlling new production capacity in traditional industries while supporting innovation in emerging sectors.

-

China can’t buy its way to a baby boom

In a significant move to combat China’s declining birth rate, the central government announced a new childcare subsidy on July 28, 2025. Families will receive 3,000 yuan ($417.76) annually for each child under three years old. This initiative follows the recent unveiling of plans to provide free preschool education nationwide, marking a shift from previous years when local authorities primarily handled such policies. Despite various local efforts, including cash incentives and housing subsidies, the national birth rate has continued to decline, with China’s population shrinking for the third consecutive year in 2024. The aging population and shrinking workforce pose long-term challenges for economic growth, healthcare, and pension systems. While some regions have seen slight increases in birth rates due to local policies, the overall impact remains minimal. The high cost of raising children, gender inequality, and structural issues like expensive housing and childcare shortages continue to deter many from starting families. The new measures reflect Beijing’s recognition of the urgency of the situation, but reversing the fertility decline may prove difficult, as seen in other countries like South Korea. To truly address the issue, comprehensive cultural and structural changes are needed, alongside financial support.

-

US willfully ceding the energy innovation race to China

During the Cold War, the United States and the Soviet Union were engaged in a fierce competition to develop advanced technologies such as long-range missiles and satellites. Today, the global technological race has shifted to artificial intelligence (AI) and next-generation energy solutions. While the US has maintained a significant lead in AI, its position in the energy sector has been undermined by political decisions rather than technological or economic factors. Since returning to the White House in January, Donald Trump has prioritized the fossil fuel industry, rolling back support for renewable energy and appointing former industry lobbyists to key political positions. This shift has had profound implications for both domestic energy costs and the global clean energy race. The Trump administration’s policies have led to increased household energy expenses, with projections indicating a rise of $170 annually until 2035 due to the One Big Beautiful Bill Act. This legislation has stripped away incentives for renewable energy, making clean energy development more cumbersome. Meanwhile, China has surged ahead, dominating the global market for wind, solar, and next-generation batteries. China’s strategic investments in renewable energy have positioned it as a leader in electric vehicle production and solar panel manufacturing. The US, despite its potential for innovation in geothermal and battery recycling technologies, has effectively withdrawn from the competition to become the world’s 21st-century energy manufacturing powerhouse. The environmental and financial costs of Trump’s fossil fuel-centric policies are becoming increasingly evident, with climate change exacerbating natural disasters across the country. As the US grapples with rising energy costs and environmental challenges, China’s foresight in embracing renewable energy offers a stark contrast to America’s current trajectory.

-

Le Monde publishes new details of campaign against Karim Khan and ICC

An alarming intimidation campaign targeting International Criminal Court Chief Prosecutor Karim Khan has been extensively documented by French publication Le Monde, revealing systematic pressure tactics from multiple nations and internal sabotage attempts. The coordinated effort emerges directly from Khan’s pursuit of war crimes charges against Israeli Prime Minister Benjamin Netanyahu, former Defense Minister Yoav Gallant, and other Israeli officials.

The campaign features direct threats against ICC personnel, including British barrister Andrew Cayley who oversaw the Palestine investigation. Dutch intelligence warned Cayley of security risks in The Hague, followed by explicit December 2024 threats labeling him ‘an enemy of Israel’ who should ‘watch his back.’ Cayley subsequently left his position citing health impacts from pressure and fear of U.S. sanctions.

Internal undermining came from Thomas Lynch, Khan’s senior legal adviser and longtime colleague tasked with liaising with Israel. Lynch allegedly proposed arranging a Jerusalem dinner between Khan and Netanyahu through lawyer Alan Dershowitz—a move Khan reportedly rejected as inappropriate spectacle. Lynch later triggered internal harassment investigations against Khan and attempted to have him suspended following sexual misconduct allegations, which Khan denies.

Government-level intimidation included then-British Foreign Secretary David Cameron’s April 23, 2024 threat that Britain would withdraw from the Rome Statute if Khan pursued arrest warrants, comparing the action to detonating ‘a hydrogen bomb.’ Similarly, British-Israeli ICC lawyer Nicholas Kaufman warned Khan in a May 1 meeting that he and the ICC would be ‘destroyed’ unless warrants were reclassified as confidential to allow private Israeli challenges.

The pressure campaign extends to tangible sanctions: Khan has had his U.S. visa revoked, family members banned from traveling to America, UK bank accounts frozen, and credit cards canceled. Despite these pressures, Khan was reportedly preparing additional warrants for far-right Israeli ministers Bezalel Smotrich and Itamar Ben Gvir over West Bank settlement expansions before taking leave amid internal turmoil. The U.S. escalated pressure further by sanctioning four ICC judges on June 8, with State Department legal adviser Reed Rubinstein warning ‘all options remain on the table’ unless the investigation is dropped.

-

China seeks power beyond water with world’s biggest dam

China has embarked on an ambitious new phase of its infrastructure development with the commencement of the Motuo hydropower project. This mega dam, comprising five cascade hydropower stations, is set to become the world’s largest source of hydroelectric power, surpassing the Three Gorges Dam by a factor of four. Chinese Premier Li Qiang has hailed it as the ‘project of the century,’ underscoring its significance in reflecting China’s geopolitical ambitions and technological prowess. However, the project’s location on the Yarlung Zangbo River, which feeds into the Brahmaputra River flowing through India and Bangladesh, has sparked regional tensions. Both nations have expressed concerns over potential disruptions to their water supplies, particularly given the already strained Sino-Indian relations over the disputed region of Arunachal Pradesh, which China refers to as Zangnan. The dam’s strategic location grants Beijing significant leverage over downstream water flows, a tactic previously demonstrated in the Mekong River Delta. Beyond its geopolitical implications, the Motuo project symbolizes China’s historical quest to control its rivers, a theme deeply rooted in its civilization. It also aligns with China’s push for energy self-sufficiency, with the dam expected to generate 300 billion kilowatt-hours annually—equivalent to the UK’s total electricity production. While the project promises economic and environmental benefits for China, it also raises concerns about its broader impact on regional water security and geopolitical dynamics in South Asia.

-

China happily and aggressively filling Trump’s climate vacuum

In early 2025, President Donald Trump’s announcement of the United States’ second withdrawal from the Paris Climate Agreement sent shockwaves through the global community. This decision raised concerns about the potential erosion of international efforts to combat climate change and the diminishing influence of the US on the world stage. The move left a leadership vacuum, prompting questions about who would step up to drive global climate action. While the long-term implications of this political shift remain uncertain, emerging leaders are already making their mark. The US initially joined the Paris Agreement in 2015 under President Barack Obama, committing to reduce greenhouse gas emissions by 26-28% below 2005 levels by 2025 and pledging financial aid to developing nations. However, by 2025, the US had only achieved a 17.2% reduction, falling short of its target. Trump’s first withdrawal in 2017, citing economic concerns and perceived unfairness, was met with widespread criticism. Despite this, the agreement endured, bolstered by commitments from US businesses, states, and cities. Globally, countries like China, the European Union, and the UK have intensified their climate efforts, filling the void left by the US. China, in particular, has emerged as a key player, leveraging its Belt and Road Initiative to expand renewable energy investments worldwide. The Paris Agreement’s flexible, nonbinding framework has proven resilient, surviving both US withdrawals. As the world prepares for COP30 in Brazil, the focus remains on balancing economic growth with ecological sustainability, with the question of global climate leadership still unresolved.

-

US-China trade talks threaten to explode over Russia oil

The United States has issued a stern warning to China, urging it to cease its purchases of oil and gas from Russia and threatening to impose secondary sanctions, including potential 100% tariffs. This development follows recent trade agreements between the US, the European Union, and Japan, which set tariffs at 15%. US Treasury Secretary Scott Bessent conveyed Washington’s dissatisfaction during meetings in Stockholm with Chinese Vice Premier He Lifeng, emphasizing concerns over China’s continued acquisition of sanctioned Russian and Iranian oil. Bessent also criticized China’s sale of over $15 billion in dual-use technology to Russia, which reportedly supports Moscow’s military efforts in Ukraine. Chinese officials responded by asserting their sovereignty and internal energy policies, stating that oil purchases are based on national interests. The US-China 90-day tariff truce, set to expire on August 12, remains unresolved, with President Donald Trump poised to decide on its extension or the reimposition of tariffs. Meanwhile, Trump has set a 10-12 day deadline for Russia to end the Ukraine conflict, threatening severe consequences, including tariffs on Russian goods and those from countries purchasing Russian oil. Chinese commentators argue that US pressure will not sever China’s ties with Russia and Iran, emphasizing the strategic importance of these relationships. The global spotlight now focuses on whether China will distance itself from Russia to avoid US tariffs.