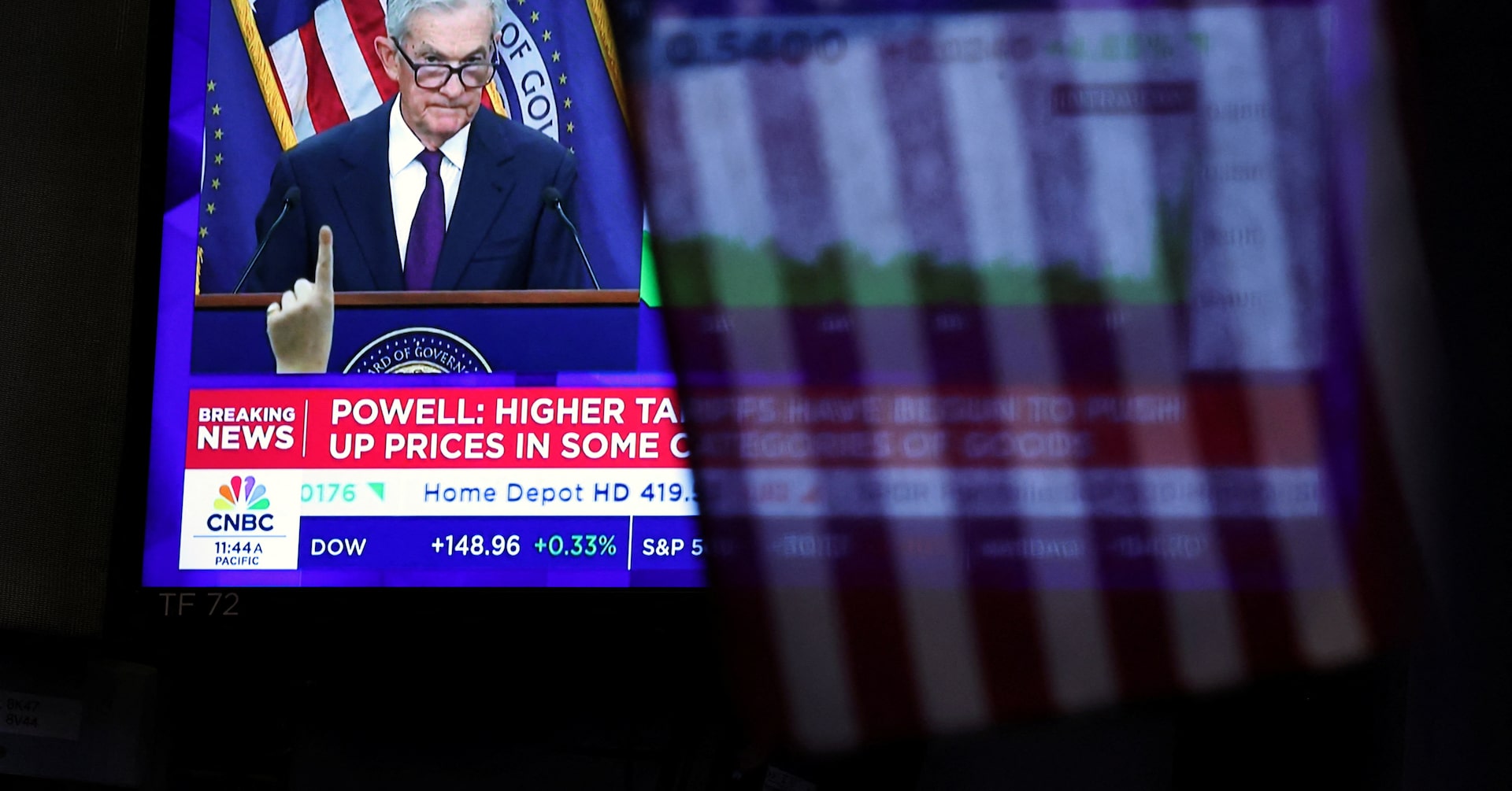

The U.S. Federal Reserve’s decision to implement its first interest rate cut of 2025 sent ripples through global markets, sparking a mix of reactions across financial sectors. While the initial announcement led to a stumble in U.S. markets, stock futures rebounded sharply ahead of Thursday’s trading session as Fed Chair Jerome Powell signaled a cautious approach to further easing. The dollar and Treasury yields experienced significant fluctuations, with the greenback hitting a multi-year low before recovering. Powell emphasized a risk-management strategy, noting that while the median projection among Fed policymakers suggests two additional cuts this year and one in 2026, a third of officials oppose further easing in 2025, and nearly half anticipate only one more cut or none at all. This divergence has left markets uncertain, with Fed futures pricing in an 85% chance of a 25-basis-point cut in October and only 44 basis points of easing for the remainder of the year. The Nasdaq and S&P 500 both dipped on Wednesday, partly due to Nvidia’s 3% decline following reports of Chinese regulators urging domestic tech firms to halt purchases of Nvidia’s AI chips. However, optimism returned as Chinese officials expressed willingness to engage in dialogue, and tech stocks like Oracle and Lyft surged on positive news. Meanwhile, global central banks are also in focus, with the Bank of Canada cutting rates as expected and the Bank of England’s decision on quantitative tightening drawing attention. The Bank of Japan is expected to hold rates but hint at future hikes, adding to the complexity of global monetary policy. As markets brace for further volatility, the Fed’s rate-cutting cycle stands in contrast to other central banks winding down their easing measures, signaling potential turbulence ahead.

标签: Asia

亚洲

-

Taiwan central bank raises growth forecast, warns of tariff risks

In a significant move, Taiwan’s central bank has decided to maintain its benchmark discount rate at 2% during its quarterly meeting, aligning with market expectations. The decision, made unanimously, reflects the bank’s cautious optimism about the island’s economic trajectory. Governor Yang Chin-long highlighted the unique nature of this year’s economic growth, driven largely by booming exports, particularly in the semiconductor sector, which has been pivotal in powering the global AI boom. Companies like Nvidia have benefited immensely from Taiwan’s advanced chip production, bolstering the local economy. However, Yang expressed concerns over the potential adverse effects of U.S. tariffs, which could necessitate adjustments in monetary policy. The central bank has revised its 2025 economic growth forecast upward to 4.55%, up from 3.05% in June, but anticipates a slowdown to 2.68% in the following year. Additionally, the bank has trimmed its consumer price index forecast for this year to 1.75%, with inflation expected to ease further to 1.66% next year. The bank remains vigilant, closely monitoring developments in U.S. tariffs and geopolitical risks, which could significantly impact Taiwan’s competitive edge. This rate decision follows the U.S. Federal Reserve’s recent rate cut, the first since December, amid concerns over rising unemployment.

-

Gold gains on softer dollar after Fed delivers rate cut

Gold prices experienced a notable uptick on Thursday, driven by a weakening dollar and the U.S. Federal Reserve’s decision to cut interest rates by 25 basis points. The Fed’s move, coupled with its indication of a gradual easing path for the remainder of the year, has significantly bolstered the appeal of the precious metal. Spot gold rose by 0.2% to $3,668.34 per ounce, following a record high of $3,707.40 on Wednesday. U.S. gold futures for December delivery, however, saw a slight decline of 0.4% to $3,703. The dollar, which had recently gained strength, retreated to near a two-month low, making gold more affordable for holders of other currencies. Concurrently, benchmark 10-year Treasury yields also decreased. Market analysts attribute the rise in gold prices to the dollar’s resumed weakness and the Fed’s dovish stance, which suggests two additional rate cuts this year. Fed Chair Jerome Powell described the rate cut as a ‘risk-management measure’ in response to a softening labor market, emphasizing a ‘meeting-by-meeting’ approach to future rate decisions. Gold, a non-yielding asset, is traditionally seen as a safe haven during periods of geopolitical and economic uncertainty, and it tends to thrive in low-interest-rate environments. Analysts, including Ross Norman, an independent market expert, believe that gold’s bull run remains robust, with record highs likely to persist. Traders are currently anticipating a 90% chance of another 25-basis point cut at the Fed’s October meeting, according to the CME Group’s FedWatch tool. ANZ Bank also predicts that gold will outperform early in the easing cycle, citing increased demand for haven assets amid a challenging geopolitical landscape. Meanwhile, other precious metals showed mixed performance, with spot silver rising 0.4% to $41.84 per ounce, platinum gaining 1.5% to $1,383.60, and palladium declining 0.7% to $1,146.55 per ounce.

-

India’s stock benchmarks hit 10-week highs on Fed rate cut, optimism over US trade talks

India’s stock market surged to a 10-week high on Thursday, driven by gains in IT and pharmaceutical sectors. The rally followed the U.S. Federal Reserve’s decision to implement a quarter-point rate cut and indications of easing trade tensions. The Nifty 50 index climbed 0.37% to 25,423.60, while the BSE Sensex rose 0.39% to 83,013.96. IT and pharmaceutical stocks, which derive significant revenue from the U.S., saw notable increases of 0.8% and 1.5%, respectively. Biocon and Natco Pharma further boosted the pharma index with gains of 4% and 3.3%, supported by favorable regulatory developments in the U.S. Twelve out of 16 major sectors recorded gains, with small-cap and mid-cap indices adding 0.3% and 0.4%, respectively. The Fed’s rate cut, its first this year, has sparked optimism among investors, though uncertainty remains about the pace of future monetary easing. Market analyst Om Ghawalkar noted that the decision could attract foreign institutional investments and bolster investor confidence. Additionally, chief economic advisor V. Anantha Nageswaran hinted at potential reductions in U.S. tariffs on certain Indian imports, further supporting market sentiment. The Nifty 50 has closed in positive territory in 11 of the last 12 sessions, now trading just 3.25% below its September 2024 peak. However, Cohance Lifesciences saw a 5.6% decline after a block deal involving an 8.9% stake at a discounted price.

-

Key products in Huawei’s AI chips and computing power roadmap

In a groundbreaking move, Chinese tech giant Huawei has broken its silence to reveal a comprehensive product roadmap for its chips and computing power systems, marking its first public strategy to compete with global leader Nvidia. The announcement, made on September 18, 2024, outlines Huawei’s plans to introduce three new Ascend series chips over the next three years, starting with the Ascend 950 in the first quarter of 2025. The Ascend 950 will come in two variants: the 950PR, optimized for inference and recommendations, and the 950DT, designed for model training and decoding. Huawei also revealed that the Ascend 960 and 970 will significantly boost computing power and memory capacity, with the 970 expected to surpass Nvidia’s offerings. Despite U.S. export restrictions limiting Huawei’s access to TSMC, the company has developed its own high-bandwidth memory (HBM) technology, which it claims is more cost-effective than SK Hynix and Samsung’s HBM3E and HBM4E. Huawei’s cluster computing systems, such as the Atlas 900 A3 SuperPoD, already rival Nvidia’s advanced products, and the company plans to launch the Atlas 950 SuperPod in Q4 2026, boasting 6.7 times more computing power than Nvidia’s NVL144 system. Additionally, Huawei’s Kunpeng CPU chip series, first introduced in 2019, will see new iterations in 2026 and 2028, accompanied by the TaiShan 950 SuperPod for general-purpose computing. This bold strategy underscores Huawei’s determination to establish itself as a major player in the global semiconductor and AI markets.

-

Indonesian parliament set to approve bigger 2026 budget for Prabowo

Indonesia’s parliament has taken a significant step toward approving a larger spending plan and a wider fiscal deficit for the 2026 budget than initially proposed by President Prabowo Subianto. On Thursday, the parliamentary fiscal oversight panel endorsed a total spending plan of 3,842.7 trillion rupiah ($233 billion), marking a 9% increase over the estimated 2025 budget. The fiscal deficit is projected to reach 2.68% of GDP, slightly higher than Prabowo’s August proposal but still below the legal threshold of 3%. The panel also set a revenue target of 3,153.6 trillion rupiah, a 10% increase over 2025 estimates. A final parliamentary vote is expected on September 23, with Prabowo’s coalition likely to secure approval. The budget aims to support Prabowo’s ambitious GDP growth target of 5.4% for 2026, with a long-term goal of 8% growth by 2029. The government plans to leverage the wider fiscal gap to drive economic growth, particularly as the U.S. Federal Reserve is expected to maintain an accommodative monetary policy until mid-2026. However, economists have cautioned against relying heavily on bond issuance to fund the deficit, urging the government to explore non-tax revenue sources. The budget also includes increased allocations for regional transfers, though they remain below 2025 levels. Regional leaders had expressed concerns over potential tax hikes to cover shortfalls, prompting the government to adjust spending plans to maintain social and political stability. Key allocations include 335 trillion rupiah for a flagship free meals program and 335.3 trillion rupiah for defense spending. The budget reflects the government’s commitment to balancing economic growth with fiscal prudence.

-

Rupee ends lower tracking Asian peers as investors parse Fed outlook

The Indian rupee experienced a decline on Thursday, September 18, 2025, mirroring the downward trend of other Asian currencies. This movement followed the U.S. Federal Reserve’s anticipated interest rate cut and its cautious approach to further easing of benchmark borrowing costs. The rupee closed at 88.13 against the U.S. dollar, marking a 0.36% drop for the day. Meanwhile, Asian currencies saw declines ranging from 0.1% to 0.6%. The U.S. dollar index, which measures the dollar against a basket of major currencies, dipped slightly to 96.9 but remained above a 3.5-year low reached immediately after the Fed’s policy announcement. HSBC analysts noted that the Fed’s stance, while consistent with market expectations, leaned more towards hawkishness than dovishness. Traders predict that the rupee will exhibit two-way price action in the near term, influenced by broader dollar movements, with support near 88.45 and resistance around 87.75-87.80. A Reuters poll revealed that investors have increased short positions on the Indian rupee and the Indonesian rupiah, driven by concerns over central bank rate cuts in Indonesia and U.S. tariffs impacting India. Bearish bets on the rupee have surged to their highest level since early February. In a positive development, India’s Chief Economic Adviser V. Anantha Nageshwaran hinted that the U.S. might soon eliminate the punitive tariff on Indian goods and reduce the reciprocal tariff from 25% to 10-15%. India’s benchmark equity indexes, the BSE Sensex and Nifty 50, each rose nearly 0.4%, while the yield on the benchmark 10-year bond increased by 4 basis points to 6.51%. Tight rupee liquidity, caused by income tax outflows, led to higher daily funding costs, prompting banks to turn to the foreign exchange swap market. The swap rate between Wednesday and Thursday peaked at 0.50 paisa, indicating a rupee interest rate of over 6%, as banks sought funds at elevated costs.

-

Co-build mechanism for coexistence

The 12th Beijing Xiangshan Forum, a prominent international security dialogue, convened at the Beijing International Convention Center from September 17 to 19, 2025. This year’s forum centered on the theme ‘Upholding International Order and Promoting Peaceful Development,’ drawing global attention to the pressing need for stability and cooperation in an increasingly complex geopolitical landscape. Among the distinguished speakers was Chad Sbragia, former US deputy assistant secretary of defense, who shared his insights on fostering coexistence in a divided world. His remarks underscored the importance of dialogue, mutual understanding, and collaborative mechanisms to address global challenges. The forum also highlighted significant developments in international relations, including the signing of a mutual defense agreement between Saudi Arabia and Pakistan, as well as urgent calls from global leaders for an immediate ceasefire in Gaza. The event served as a platform for nations to reaffirm their commitment to peace, security, and sustainable development, emphasizing the collective responsibility to build a harmonious global order.

-

Saudi-Pakistan defense pact more symbolism than substance

Saudi Arabia and Pakistan have inked a Strategic Mutual Defense Agreement (SMDA), a pact designed to bolster defense collaboration and enhance joint deterrence against potential aggressions. The agreement stipulates that an attack on either nation will be regarded as an attack on both, echoing the strategic ambiguity of NATO’s Article 5. However, it stops short of mandating military intervention, leaving the specifics of support open to interpretation. The move comes as Saudi Arabia, a key U.S. ally, reportedly seeks to counterbalance Israel’s actions in the region, particularly in light of recent conflicts in Gaza. By aligning with nuclear-armed Pakistan, Saudi Arabia aims to strengthen its defensive posture, while Pakistan may gain Saudi support in its longstanding tensions with India. Despite the pact’s symbolic significance, analysts argue that its practical impact may be limited. Pakistan has historically avoided direct confrontation with Israel, even in its conflicts with India, and Saudi Arabia maintains strong economic ties with India, its major oil importer. The agreement is seen more as a gesture of solidarity within the Muslim world rather than a transformative military alliance. The most plausible scenario for mutual military support would involve the Houthi rebels in Yemen, should they escalate hostilities against Saudi Arabia. While the SMDA has sparked debate, its real-world implications remain uncertain, with many viewing it as a strategic maneuver rather than a game-changing alliance.

-

Taiwan’s spending bonanza draws more foreign firms to its largest arms show

Taiwan has launched its largest-ever arms exhibition, the Taipei Aerospace and Defence Technology Exhibition, showcasing a significant increase in participation from both domestic and international defense firms. The event, held biennially, has attracted 490 exhibitors across 1,500 booths, a substantial rise from the 275 exhibitors and 960 booths in 2023. This surge in interest comes as Taiwan ramps up its defense spending, aiming to allocate 5% of its GDP to military expenditures by 2030, up from the current 3.3% for next year. The heightened focus on defense is driven by escalating military pressure from China, which views Taiwan as part of its territory and has intensified its military drills and incursions into nearby areas. The United States, Taiwan’s primary arms supplier, has notably expanded its presence at the exhibition, with over 40 companies participating, double the number from two years ago. Karin Lang, deputy director of the American Institute in Taiwan, emphasized the importance of U.S.-Taiwan collaboration in addressing supply chain vulnerabilities, technological competition, and evolving security threats. The exhibition also highlighted Taiwan’s growing defense cooperation with the U.S., including the unveiling of its first jointly developed missile with a U.S. company. Additionally, Taiwan’s National Chung-Shan Institute of Science and Technology announced plans to sign agreements with U.S. and Canadian firms for advanced weaponry, such as anti-drone rockets and underwater surveillance drones. Major defense contractors like Lockheed Martin and Northrop Grumman are also prominent participants, reflecting the island’s strategic push to bolster its military capabilities amidst rising regional tensions.