India’s Securities and Exchange Board (Sebi) has officially dismissed allegations of stock manipulation and financial fraud against billionaire Gautam Adani and his conglomerate, which were initially raised by US short-seller Hindenburg Research. The investigation, launched in 2023 following Hindenburg’s explosive report, concluded that Adani’s companies did not violate regulatory norms. Sebi’s findings revealed no evidence of undisclosed transactions between Adani’s firms and related parties, nor any signs of market manipulation, money siphoning, or investor losses. Adani, one of Asia’s wealthiest individuals, celebrated the decision on social media, stating that Sebi’s ruling reaffirmed the baseless nature of Hindenburg’s claims. The allegations had previously caused Adani’s group to lose over $100 billion in market value within days. The controversy also fueled political tensions in India, with the opposition Congress party accusing Prime Minister Narendra Modi’s BJP of inaction. Hindenburg’s founder, Nate Anderson, recently announced the dissolution of the firm, citing personal reasons. The case underscores the complexities of financial scrutiny and the impact of short-selling on global markets.

标签: Asia

亚洲

-

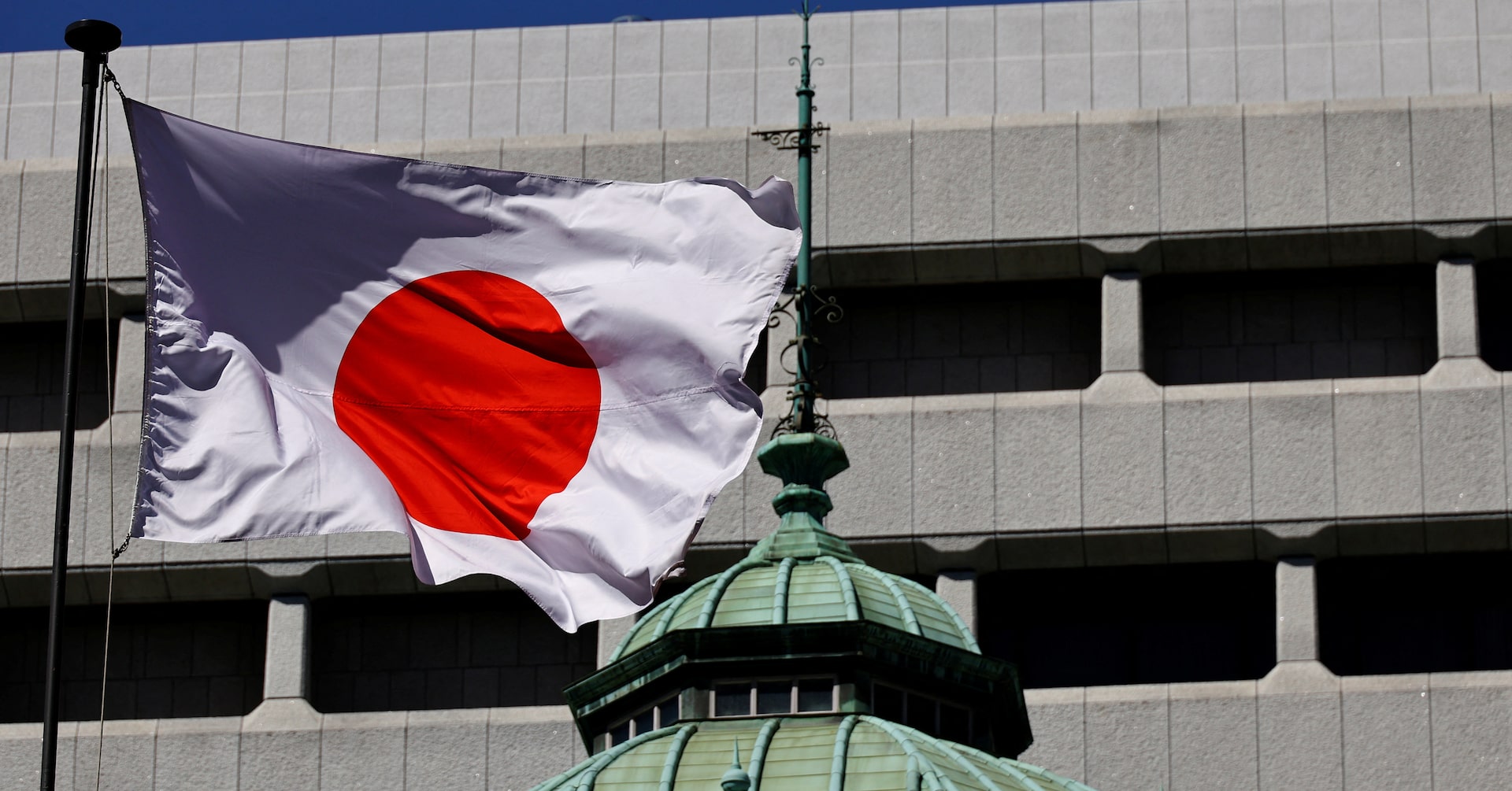

BOJ to keep interest rates steady as tariff, US slowdown risks loom

The Bank of Japan (BOJ) concluded its two-day policy meeting on Friday, September 19, 2024, with expectations of maintaining its short-term interest rate at 0.5%. This decision comes amidst growing concerns over the impact of U.S. President Donald Trump’s tariffs and signs of a weakening U.S. economy. The BOJ’s cautious stance reflects the fragile state of Japan’s economic recovery, which is increasingly vulnerable to external pressures, particularly on exports. Governor Kazuo Ueda is scheduled to hold a news conference at 0630 GMT, where markets will closely monitor his views on the tariff implications and the broader economic outlook. Analysts predict that the BOJ will remain cautious in its approach, with potential rate hikes delayed until early next year. The central bank’s policy outlook is further complicated by domestic political uncertainty, as Japan’s ruling party prepares for a leadership race following Prime Minister Shigeru Ishiba’s resignation earlier this month. Despite global uncertainties, some hawkish BOJ members have warned of the risks of prolonged negative real borrowing costs, driven by stubbornly high food prices and a tight job market. Japan’s consumer inflation has remained above the BOJ’s 2% target for over three years, adding pressure on households’ cost of living. The BOJ exited its decade-long stimulus program last year and raised rates in January, but the path forward remains uncertain as policymakers navigate the dual challenges of domestic inflation and external economic risks.

-

Virtual K-pop stars win lawsuit against critic on social media

In a landmark ruling, a South Korean court has ordered a social media user to pay 500,000 won ($360; £265) for defaming the virtual K-pop boyband Plave. The group, whose members are animated characters voiced and performed by anonymous real-life individuals through motion-capture technology, has become a sensation in South Korea’s entertainment industry. The case, filed by Plave’s agency, Vlast, marks one of the first legal disputes involving virtual K-pop idols. The defendant had posted derogatory remarks online, including comments questioning the appearance and character of the real performers behind the avatars. The court ruled that attacks on widely recognized avatars also constitute defamation of the real individuals they represent. While Vlast sought 6.5 million won for each performer, the court awarded 100,000 won per person, citing the severity of the comments and the context of the incident. Vlast has appealed the decision, emphasizing the case’s significance in setting a precedent for protecting virtual avatars. Advocates argue that virtual idols can reduce the intense scrutiny faced by human performers, offering a new frontier in the K-pop industry.

-

Trump says it sounds like China has approved TikTok deal

In a recent interview with Fox News on Thursday, President Donald Trump revealed that China appears to have approved a deal concerning TikTok, ensuring the popular short-video app’s continued operation in the United States. This announcement follows a high-profile agreement reached earlier this week between the U.S. and China. ‘We had a very productive meeting, and it seems they’ve given their nod to TikTok,’ Trump stated during his appearance on ‘The Story with Martha MacCallum.’ The deal, which transitions TikTok to U.S.-controlled ownership, was described by Chinese state media as a ‘win-win’ outcome. China has also committed to reviewing TikTok’s technology exports and intellectual property licensing as part of the agreement. Trump and Chinese President Xi Jinping are scheduled to discuss the matter further in an upcoming call on Friday. This development marks a significant step in U.S.-China relations, particularly in the realm of technology and digital commerce.

-

Bessent says China’s yuan rate is bigger problem for Europe than US

In a recent interview in Madrid, U.S. Treasury Secretary Scott Bessent emphasized that China’s yuan valuation poses a more significant challenge for Europe than for the United States. Bessent noted that while the yuan has strengthened against the U.S. dollar this year, it has reached record lows against the euro, exacerbating trade imbalances between China and the European Union. Speaking to Reuters and Bloomberg following U.S.-China trade discussions, Bessent highlighted that U.S. tariffs on Chinese imports have effectively reduced the U.S. trade deficit, with U.S.-China trade declining by 14% this year. In contrast, Chinese trade with Europe has surged by 6.9%. The yuan, also referred to as the renminbi (RMB), has weakened to over 8.4 against the euro, compared to 7.5 at the start of 2025. This depreciation has facilitated a surge in Chinese exports to Europe, intensifying the EU’s trade deficit with China and escalating trade tensions between Brussels and Beijing. Meanwhile, the yuan has appreciated slightly against the dollar, moving from 7.3 in January to 7.1 currently. When questioned about potential currency manipulation, Bessent remarked that the yuan is a ‘closed currency,’ implying that its value is managed by Chinese authorities. The ongoing dynamics underscore the complex interplay between global currencies and trade relationships, with Europe bearing the brunt of the yuan’s recent fluctuations.

-

Australia’s watered down emissions target draws ire of environmentalists

Australia has announced its 2035 emissions reduction target, aiming to cut emissions by 62%-70% from 2005 levels. However, this figure has drawn sharp criticism from environmental groups, who argue it lacks ambition and prioritizes industry over vulnerable communities. The target falls below the 65%-75% range initially suggested by the Climate Change Authority, an independent advisory body. Climate Change and Energy Minister Chris Bowen defended the decision, stating that the target must be both ambitious and achievable, with a reduction beyond 70% deemed unrealistic. Greenpeace Australia Pacific’s Shiva Gounden condemned the plan, accusing the government of favoring coal and gas profits over the safety of Pacific and Australian communities. WWF-Australia CEO Dermot O’Gorman echoed these concerns, labeling the target as ‘dangerously short of what the science demands.’ Despite the backlash, the Labor government has committed billions of dollars to clean energy initiatives, including A$5 billion for industrial decarbonization and A$2 billion for the Clean Energy Finance Corporation. The government also aims to host the 2026 COP31 summit in partnership with Pacific nations. However, tensions remain over Australia’s decision to extend the life of a major natural gas project and its reluctance to phase out aging coal power plants, which critics argue hinders renewable energy adoption. Prime Minister Anthony Albanese emphasized Australia’s commitment to climate action, stating it is crucial for the nation’s neighbors, economy, and future generations.

-

India’s net direct tax collections rise over 9% y/y in April-Sep

India’s direct tax collections have shown a robust growth trajectory in the first half of the fiscal year, according to a government statement released on Thursday. From April 1 to September 17, net direct tax revenues surged by over 9% year-on-year, reaching 10.8 trillion rupees. On a gross basis, which includes both corporate and personal taxes, collections climbed by more than 3% to 12.4 trillion rupees during the same period. The income tax department highlighted that this growth reflects the country’s economic resilience and improved tax compliance. Additionally, the government issued tax refunds amounting to 1.6 trillion rupees, marking a 24% decline compared to the previous year. This reduction in refunds suggests a more efficient tax administration and tighter fiscal management. The data underscores India’s ongoing economic recovery and its ability to sustain revenue growth despite global uncertainties.

-

India’s federal investigator charges Anil Ambani, former Yes Bank CEO in alleged loan fraud

India’s Central Bureau of Investigation (CBI) has formally filed chargesheets in a high-profile case involving alleged fraudulent transactions between Yes Bank, companies owned by billionaire Anil Ambani, and entities linked to the bank’s former CEO, Rana Kapoor. The investigation reveals that in 2017, Yes Bank invested over 50 billion rupees ($567.21 million) in two Ambani-controlled firms, despite warnings from rating agencies about financial risks. The funds were reportedly siphoned off, leading to a systematic diversion of public money. CBI alleges that Kapoor misused his position to channel bank funds into financially troubled Ambani group companies, which in turn provided concessional loans to businesses associated with Kapoor’s family. This arrangement allegedly caused a loss of 27.97 billion rupees ($317.29 million) to Yes Bank while benefiting Ambani’s firms and Kapoor’s family-linked companies. Neither Anil Ambani’s spokesperson nor Rana Kapoor has responded to requests for comment. The case highlights significant governance lapses and financial misconduct in India’s banking sector.

-

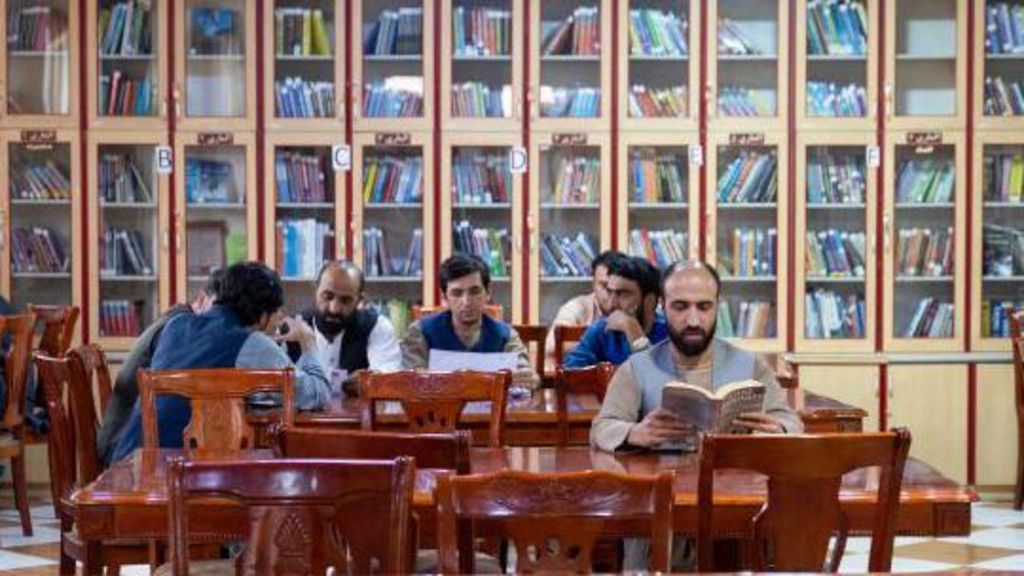

Taliban ban books written by women from Afghan universities

In a significant move, the Taliban government has mandated the removal of books authored by women from university curricula across Afghanistan. This decision is part of a broader ban that also prohibits the teaching of human rights and sexual harassment. A total of 680 books, including 140 written by women, have been flagged as ‘problematic’ due to their perceived opposition to Sharia law and Taliban policies. Additionally, universities have been instructed to cease teaching 18 specific subjects, which the Taliban claims conflict with Islamic principles and their governance policies. Among the banned subjects are Gender and Development, The Role of Women in Communication, and Women’s Sociology. This decree is the latest in a series of restrictive measures implemented by the Taliban since their return to power four years ago. Women and girls have been disproportionately affected, with access to education beyond the sixth grade already barred. The recent closure of midwifery courses in late 2024 further limited their educational opportunities. The Taliban asserts that their policies align with Afghan culture and Islamic law, but critics argue these measures are deeply misogynistic. Zakia Adeli, a former deputy minister of justice and one of the authors whose books were banned, expressed little surprise, stating that the Taliban’s actions over the past four years made such decisions predictable. The new guidelines, issued in late August, were reportedly formulated by a panel of religious scholars and experts. The ban also targets books by Iranian authors and publishers, with officials citing concerns over the ‘infiltration of Iranian content’ into Afghan education. A professor at Kabul University revealed that faculty members are now forced to create their own textbook chapters, raising questions about the quality and global standards of these materials. The BBC has reached out to the Taliban’s Ministry of Education for further comment.

-

India’s Chopra says back injury derailed javelin world title defence

In a disappointing turn of events, Neeraj Chopra, India’s celebrated javelin thrower, finished eighth in the men’s javelin event at the World Athletics Championships held in Tokyo on September 18, 2025. Competing at the National Stadium, the same venue where he secured India’s first Olympic athletics gold in 2021, Chopra managed a best throw of 84.03 meters, falling short of his qualifying mark from the previous day. This performance marked a stark contrast to his usual dominance in the sport.

Chopra revealed that he had been secretly battling a back injury for weeks, which significantly impacted his performance. ‘I don’t understand what happened today. This has not happened for a long time. I had some problems before coming to Tokyo,’ he admitted. The injury, sustained on September 4, forced him to undergo an MRI scan, and he acknowledged that he was not at full fitness. ‘Two weeks ago I had some back issues but I didn’t want to tell anyone. I was thinking I would still manage to get through it. But javelin is really tough. If you are not in good shape, you’re out,’ he added.

Despite the setback, Chopra remained optimistic about his future in the sport. ‘Normally it doesn’t happen with me because for a long time, I was always in the top two positions. After a long time, I’m not in the position, but it’s okay. I will learn from today and try to stay healthy and focus on my technique,’ he said. He also emphasized the need for more training and technical improvements to regain his form.

Meanwhile, Trinidad and Tobago’s Keshorn Walcott clinched his first global title since his teenage Olympic triumph in 2012, with a throw of 88.16 meters. Grenada’s Anderson Peters and American Curtis Thompson completed the podium, securing second and third places, respectively.

Chopra’s performance serves as a reminder of the physical and mental challenges athletes face, even at the highest levels of competition. His resilience and determination to bounce back from this setback will be closely watched by fans and analysts alike.